Valid West Virginia Articles of Incorporation Document

Key takeaways

When filling out and using the West Virginia Articles of Incorporation form, it is essential to understand several key points to ensure a smooth process. Below are important takeaways to consider:

- Choose the Right Business Structure: Before completing the form, determine the type of corporation you want to establish, such as a nonprofit or a for-profit entity.

- Provide Accurate Information: Ensure that all information is correct and up-to-date, including the name of the corporation, its principal office address, and the names of the incorporators.

- Include Required Provisions: Familiarize yourself with the mandatory provisions that must be included in the Articles of Incorporation, such as the purpose of the corporation and the number of shares authorized.

- File with the Secretary of State: After completing the form, submit it to the West Virginia Secretary of State’s office, along with any required fees.

- Understand the Review Process: Be aware that the Secretary of State will review the submission for compliance with state laws before granting approval.

- Keep Copies for Your Records: After filing, retain copies of the Articles of Incorporation and any correspondence for your records, as they are important for future reference.

By following these guidelines, you can navigate the process of filing the Articles of Incorporation in West Virginia more effectively.

Other Common West Virginia Templates

Gun Laws in Wv - Documents the transfer of ownership for a firearm.

When considering legal documents for your child, understanding the implications of a temporary Power of Attorney for a Child is crucial. This form enables designated adults to make important decisions regarding your child's welfare in your absence.

Wv Dmv Title Online - Use this form for a smooth private sale of a trailer.

Misconceptions

Understanding the Articles of Incorporation form for West Virginia can be confusing. Here are ten common misconceptions about this important document:

- All businesses need Articles of Incorporation. Not every business requires this form. Sole proprietorships and partnerships, for instance, do not need to file Articles of Incorporation.

- Filing Articles of Incorporation guarantees business success. While filing the form is necessary for legal recognition, it does not ensure profitability or success in the market.

- Articles of Incorporation are the same as a business license. These are different documents. The Articles establish the business's legal structure, while a business license permits operation within a specific locality.

- You can change your Articles of Incorporation at any time. Changes can be made, but they often require a formal amendment process and may involve additional fees.

- All information on the Articles is private. Some details, like the names of directors and registered agents, are public records and can be accessed by anyone.

- Once filed, Articles of Incorporation never need to be updated. This is incorrect. Any significant changes in business structure or management must be reflected in updated Articles.

- You can file Articles of Incorporation online only. While online filing is available, you can also submit paper forms by mail if preferred.

- Articles of Incorporation can be filed without a lawyer. Although hiring a lawyer is helpful, individuals can file the form themselves if they understand the requirements.

- All states have the same Articles of Incorporation requirements. Each state has its own rules and forms, so it’s important to follow West Virginia’s specific guidelines.

- Filing Articles of Incorporation is a one-time task. Businesses must remain compliant with state regulations, which may include annual reports and fees after incorporation.

By addressing these misconceptions, individuals can better navigate the process of forming a corporation in West Virginia.

Similar forms

The Articles of Incorporation form is similar to the Certificate of Incorporation, which serves a similar purpose in establishing a corporation. Both documents outline key details such as the corporation’s name, purpose, and the number of shares it is authorized to issue. The Certificate of Incorporation is often used interchangeably with Articles of Incorporation in many states, reflecting the same foundational information required to legally create a corporation.

Another document that parallels the Articles of Incorporation is the Bylaws of a corporation. While the Articles of Incorporation establish the corporation's existence, the Bylaws provide the internal rules governing the corporation's operations. They detail how the corporation will be managed, including the roles of directors and officers, meeting procedures, and voting rights, which are essential for smooth governance.

The Operating Agreement for Limited Liability Companies (LLCs) shares similarities with the Articles of Incorporation. Both documents are foundational for their respective entities, outlining the structure and management of the business. The Operating Agreement specifies the roles of members, the distribution of profits, and operational procedures, akin to how the Articles define the corporation's framework.

The Partnership Agreement is another document that resembles the Articles of Incorporation. Like the Articles, a Partnership Agreement outlines the structure of the business, detailing the roles and responsibilities of each partner. It establishes how profits and losses will be shared and provides guidelines for decision-making, ensuring clarity among partners similar to the clarity sought in corporate formation documents.

The Certificate of Good Standing is related to the Articles of Incorporation as it confirms that a corporation has been properly established and is compliant with state regulations. This document is often required for various business transactions and demonstrates that the corporation has fulfilled its legal obligations, similar to how the Articles initially establish those obligations.

In the realm of corporate documentation, the Recommendation Letter form provides an important supplementary evaluation, shining light on an individual's qualifications and character through testimonials from those who know them best. Similar to the foundational documents like the Articles of Incorporation or Bylaws, having a well-crafted recommendation can greatly enhance a candidate's profile when seeking opportunities. Resources for how to effectively create such letters can be found at TopTemplates.info, assisting individuals in obtaining valuable endorsements that support their professional journeys.

Another related document is the Statement of Information, which is often required by states after the Articles of Incorporation are filed. This document provides updated information about the corporation, such as its address and the names of its officers and directors. It serves to keep the state informed and is crucial for maintaining good standing, just as the Articles establish the initial framework.

The Annual Report is akin to the Articles of Incorporation in that it is a required document that keeps the state informed about the corporation’s ongoing activities. While the Articles are filed at the inception, the Annual Report is submitted yearly to provide updates on financial status, business activities, and changes in management, ensuring transparency and compliance.

The Certificate of Amendment is similar to the Articles of Incorporation in that it is used to make changes to the original Articles. If a corporation decides to change its name, purpose, or structure, a Certificate of Amendment is filed to officially document those changes. This process reflects the evolving nature of a business, much like the initial establishment of the corporation through the Articles.

The Foreign Corporation Registration is another document that relates to the Articles of Incorporation. When a corporation formed in one state wishes to operate in another, it must file this registration. This document serves to recognize the corporation’s existence in a new jurisdiction, similar to how the Articles establish its presence in the original state.

Lastly, the Dissolution Document is connected to the Articles of Incorporation as it formally ends the existence of a corporation. When a corporation ceases operations, it must file a dissolution document to notify the state and complete the winding-up process. This document is crucial for closing the business legally, just as the Articles were essential for its legal formation.

Key Facts about West Virginia Articles of Incorporation

What is the purpose of the West Virginia Articles of Incorporation form?

The West Virginia Articles of Incorporation form is a legal document that establishes a corporation in the state. It outlines essential information about the corporation, including its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this form is a crucial step in the incorporation process, as it officially creates the corporation as a separate legal entity.

Who can file the Articles of Incorporation in West Virginia?

Any individual or group of individuals can file the Articles of Incorporation. This includes business owners, entrepreneurs, and legal representatives. However, at least one person must serve as the incorporator, who will be responsible for signing the document and ensuring that it is filed correctly with the state.

What information is required on the Articles of Incorporation form?

The form requires several key pieces of information. This includes the corporation's name, which must be unique and not similar to any existing business in West Virginia. You will also need to provide the purpose of the corporation, the name and address of the registered agent, and details about the shares the corporation will issue. Additionally, the names and addresses of the initial directors may also be required.

How much does it cost to file the Articles of Incorporation in West Virginia?

The filing fee for the Articles of Incorporation in West Virginia varies depending on the type of corporation you are forming. Generally, the fee ranges from $50 to $100. It's important to check the latest fee schedule on the West Virginia Secretary of State's website, as fees can change. Payment can typically be made via check or credit card when submitting the form.

How long does it take to process the Articles of Incorporation?

The processing time for the Articles of Incorporation can vary. Typically, it takes about 5 to 10 business days for the West Virginia Secretary of State's office to process the application. However, expedited services may be available for an additional fee, which can significantly reduce the waiting time. Always confirm current processing times directly with the Secretary of State's office.

What happens after the Articles of Incorporation are filed?

Once the Articles of Incorporation are filed and approved, the corporation is officially created. You will receive a certificate of incorporation, which serves as proof of your corporation's existence. After this, you must comply with ongoing requirements, such as obtaining necessary licenses, filing annual reports, and maintaining good standing with the state. Failing to do so can jeopardize your corporation's status.

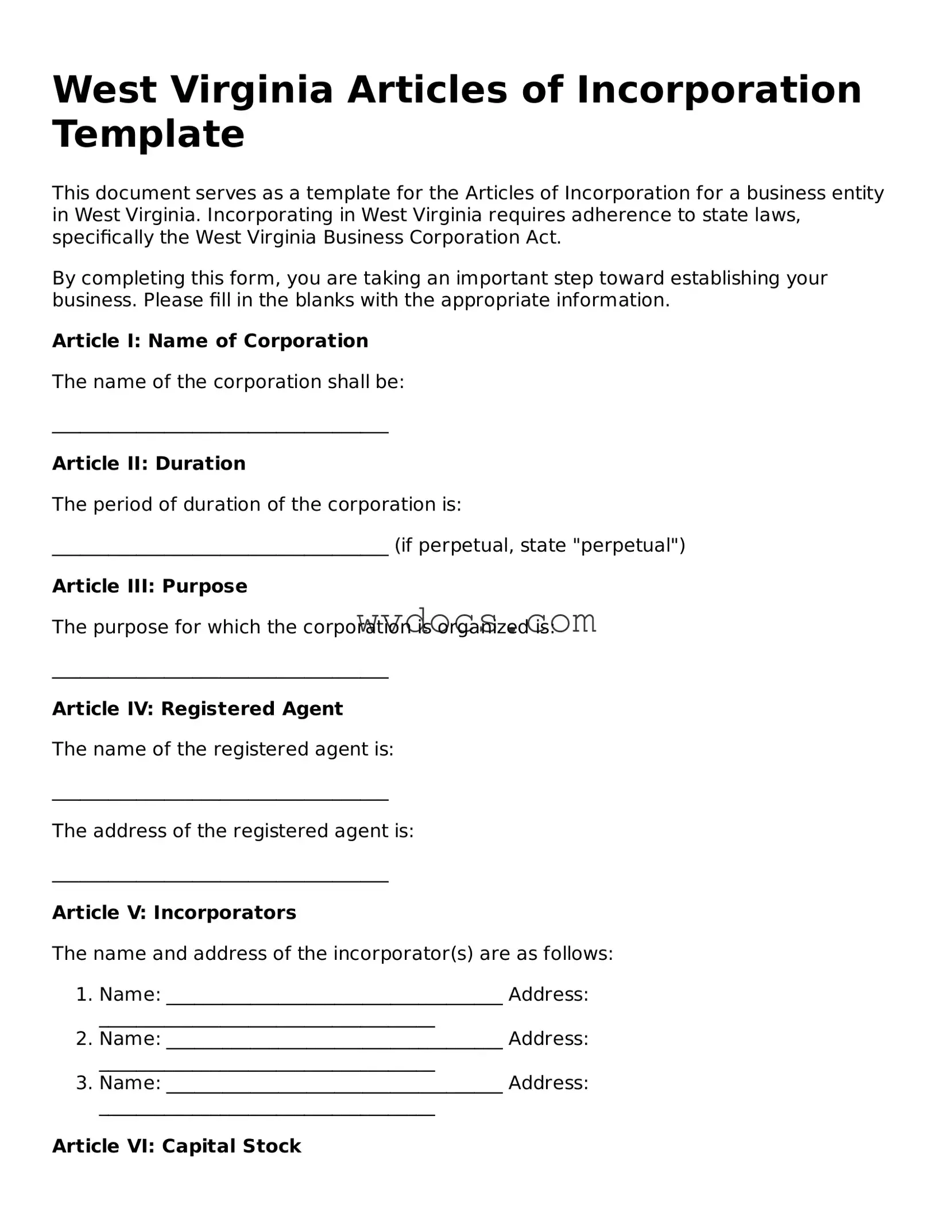

Preview - West Virginia Articles of Incorporation Form

West Virginia Articles of Incorporation Template

This document serves as a template for the Articles of Incorporation for a business entity in West Virginia. Incorporating in West Virginia requires adherence to state laws, specifically the West Virginia Business Corporation Act.

By completing this form, you are taking an important step toward establishing your business. Please fill in the blanks with the appropriate information.

Article I: Name of CorporationThe name of the corporation shall be:

____________________________________

Article II: DurationThe period of duration of the corporation is:

____________________________________ (if perpetual, state "perpetual")

Article III: PurposeThe purpose for which the corporation is organized is:

____________________________________

Article IV: Registered AgentThe name of the registered agent is:

____________________________________

The address of the registered agent is:

____________________________________

Article V: IncorporatorsThe name and address of the incorporator(s) are as follows:

- Name: ____________________________________ Address: ____________________________________

- Name: ____________________________________ Address: ____________________________________

- Name: ____________________________________ Address: ____________________________________

The total number of shares which the corporation is authorized to issue is:

____________________________________

The par value of the shares is:

____________________________________

Article VII: Initial Board of DirectorsThe names and addresses of the directors who are to serve until the first annual meeting or until their successors are elected and qualified are:

- Name: ____________________________________ Address: ____________________________________

- Name: ____________________________________ Address: ____________________________________

- Name: ____________________________________ Address: ____________________________________

IN WITNESS WHEREOF, the undersigned, being the incorporator(s), have executed these Articles of Incorporation as of this _____ day of __________, 20__.

__________________________________________

Signature of Incorporator

__________________________________________

Print Name

Address: _____________________________________

Documents used along the form

When you're starting a business in West Virginia, filing the Articles of Incorporation is just one step in the process. Several other forms and documents may be necessary to ensure your corporation is set up correctly and operates smoothly. Here’s a list of commonly used documents that often accompany the Articles of Incorporation.

- Bylaws: This document outlines the internal rules and procedures for your corporation. It covers aspects like how meetings are conducted, the roles of officers, and how decisions are made.

- Initial Report: Some states require an initial report shortly after incorporation. This document provides basic information about the corporation, including its address and the names of its directors.

- Employer Identification Number (EIN): An EIN is essential for tax purposes. It’s like a Social Security number for your business and is needed for hiring employees and opening a business bank account.

- Business License: Depending on your industry and location, you may need specific licenses or permits to legally operate your business.

- Application Fee Waiver: If you are an Arizona resident experiencing financial hardship related to admission fees, be sure to complete the Arizona University Application form to request a waiver for undergraduate admission fees at Arizona State University, Northern Arizona University, or the University of Arizona.

- Registered Agent Consent Form: This form shows that your registered agent agrees to represent your corporation. A registered agent is a person or business designated to receive legal documents on behalf of your corporation.

- Stock Certificates: If your corporation will issue stock, you’ll need stock certificates to represent ownership shares. These documents are often issued to shareholders after incorporation.

- Meeting Minutes: Keeping minutes of meetings is crucial for maintaining corporate records. These documents provide a formal record of decisions made during board meetings and shareholder meetings.

- Annual Report: Many states require corporations to file an annual report. This document updates the state on your corporation’s activities and confirms that it is still in operation.

Gathering these documents and understanding their purposes will help you navigate the incorporation process more effectively. Each plays a vital role in ensuring your corporation is compliant and ready for business.