Valid West Virginia Deed Document

Key takeaways

When dealing with property transactions in West Virginia, understanding how to fill out and use the deed form is crucial. Here are some key takeaways to keep in mind:

- Identify the Parties: Clearly state the names and addresses of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Property Description: Provide a detailed description of the property being transferred. This includes the physical address and any relevant legal descriptions.

- Consideration: Mention the consideration, or the value exchanged for the property. This could be a specific dollar amount or other forms of compensation.

- Signatures Required: Ensure that the deed is signed by the grantor. If there are multiple grantors, all must sign.

- Notarization: The deed must be notarized to be legally binding. This adds a layer of authenticity to the document.

- Recording the Deed: After completing the deed, it should be recorded at the local county clerk’s office. This protects the grantee’s ownership rights.

- Tax Implications: Be aware of any transfer taxes that may apply when filing the deed. Consult with a tax professional if needed.

- Review Local Laws: Different counties may have specific requirements or forms. Always check local regulations before proceeding.

- Keep Copies: After filing, retain copies of the deed for your records. This is important for future reference and legal purposes.

By following these guidelines, you can navigate the process of filling out and using the West Virginia deed form more effectively.

Other Common West Virginia Templates

Buying a House on Contract Template - Establishes the conditions under which deposits are refundable.

Wv Lease - This form is pivotal in establishing a legal framework that protects both parties' interests.

For anyone engaging in the sale of an ATV, it is essential to utilize the proper documentation, such as the California ATV Bill of Sale form, which is not only vital for legal purposes but also helps safeguard both the buyer and seller's interests. To learn more about this form and its specific requirements, visit https://onlinelawdocs.com/california-atv-bill-of-sale/.

How to Get Power of Attorney in Virginia - Be sure to discuss potential scenarios with your agent so they are prepared to act when needed.

Misconceptions

Understanding the West Virginia Deed form can be challenging due to various misconceptions. Here are ten common misunderstandings and explanations for each.

- All deeds are the same. Many people think all deeds are identical. In reality, there are different types of deeds, such as warranty deeds and quitclaim deeds, each serving different purposes.

- You don’t need a deed for a property transfer. Some believe that informal agreements are enough for transferring property. However, a deed is a legal document that formally transfers ownership.

- Only lawyers can prepare a deed. While lawyers can help, individuals can also prepare a deed, provided they follow the necessary legal requirements.

- Deeds do not need to be recorded. Some think that recording a deed is optional. In West Virginia, recording is essential to protect ownership rights and inform the public.

- Once a deed is signed, it’s final. People may assume that signing a deed is the end of the process. However, a deed must be delivered and accepted to be effective.

- All property transfers require a notary. While notarization is common, some simple transactions may not require a notary in West Virginia.

- Only property owners can create a deed. This is not true. A person with the authority, like an agent or attorney, can create a deed on behalf of the owner.

- Deeds are only needed for selling property. Many think deeds are only for sales. However, they are also used for gifts, inheritance, and other transfers.

- A deed can be changed after it’s recorded. Some believe they can easily modify a deed. Changes typically require a new deed to be created and recorded.

- The deed form is the same for all counties. While the basic elements are similar, specific requirements may vary by county in West Virginia.

Being aware of these misconceptions can help ensure a smoother property transfer process in West Virginia.

Similar forms

The West Virginia Deed form shares similarities with the Quitclaim Deed. Both documents are used to transfer ownership of real property. A Quitclaim Deed, however, does not guarantee that the grantor holds valid title to the property. Instead, it simply conveys whatever interest the grantor may have. This makes it a common choice among family members or in situations where the property’s title history is not a concern. While the West Virginia Deed form provides more assurance regarding the title, both serve the primary purpose of transferring property rights.

Another document akin to the West Virginia Deed is the Warranty Deed. Like the West Virginia Deed, a Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. This document offers more protection to the buyer, as it includes promises that the property is free from liens or encumbrances. In contrast to the Quitclaim Deed, the Warranty Deed assures the buyer that if any title issues arise, the seller will be responsible for resolving them. This makes it a preferred option in most real estate transactions.

The West Virginia Deed form is also similar to the Bargain and Sale Deed. This type of deed conveys property without any warranties against encumbrances, but it implies that the grantor has ownership of the property. While it does not offer the same level of protection as a Warranty Deed, it is more secure than a Quitclaim Deed. In this way, both the Bargain and Sale Deed and the West Virginia Deed facilitate property transfers while addressing varying levels of risk for the buyer.

In addition to these various deed forms, individuals looking to engage in mobile home transactions in New York should consider utilizing a New York Mobile Home Bill of Sale form. This essential document helps ensure clarity in the process, capturing vital information about the sale while safeguarding the rights of both the buyer and the seller. By having a record of the transaction, parties involved can establish proof of ownership transfer and protect themselves legally. For more information, you can visit smarttemplates.net.

Lastly, the Special Purpose Deed is another document that bears resemblance to the West Virginia Deed form. This type of deed is often used for specific situations, such as transferring property into a trust or conveying property for tax purposes. While the Special Purpose Deed may not be as commonly used as the other types, it still serves the essential function of transferring ownership. Both documents ensure that the transfer is executed properly, but the Special Purpose Deed is tailored to meet unique legal requirements.

Key Facts about West Virginia Deed

What is a West Virginia Deed form?

A West Virginia Deed form is a legal document used to transfer ownership of real estate from one party to another. This form outlines the details of the transaction, including the names of the parties involved, the property description, and any conditions or covenants related to the transfer. It serves as proof of ownership once recorded with the appropriate county clerk’s office.

What types of deeds are available in West Virginia?

In West Virginia, several types of deeds can be used depending on the nature of the transfer. The most common types include Warranty Deeds, which guarantee clear title to the property; Quitclaim Deeds, which transfer whatever interest the grantor has without any warranties; and Special Warranty Deeds, which offer limited guarantees. Each type serves different purposes and carries varying levels of risk for the buyer.

How do I fill out a West Virginia Deed form?

To fill out a West Virginia Deed form, begin by entering the names and addresses of the grantor (the seller) and grantee (the buyer). Next, provide a detailed legal description of the property, which can typically be found on the previous deed or through a title search. Include the date of the transfer and any specific terms or conditions. Finally, ensure that the form is signed by the grantor in the presence of a notary public to make it legally binding.

Do I need a lawyer to complete a West Virginia Deed form?

While it is not legally required to have a lawyer to complete a West Virginia Deed form, consulting with one can provide peace of mind. A legal professional can help ensure that the deed is filled out correctly and that all necessary legal requirements are met. This is particularly important for complex transactions or if there are concerns about the title or property boundaries.

Where do I file the West Virginia Deed form after completion?

Once completed, the West Virginia Deed form must be filed with the county clerk’s office in the county where the property is located. Filing fees may apply, and it’s essential to keep a copy of the recorded deed for your records. Recording the deed provides public notice of the ownership change and protects the grantee’s rights to the property.

Are there any taxes associated with transferring property in West Virginia?

Yes, when transferring property in West Virginia, the grantee may be responsible for paying a transfer tax. This tax is calculated based on the sale price of the property. It's important to check with the local county clerk’s office for the specific rates and any exemptions that may apply. Additionally, there may be other fees associated with the recording process.

What happens if the West Virginia Deed form is not recorded?

If the West Virginia Deed form is not recorded, the transfer of ownership may not be recognized by third parties. This can lead to complications, such as disputes over ownership or difficulties in selling the property in the future. Recording the deed protects the rights of the new owner and ensures that the transaction is legally acknowledged.

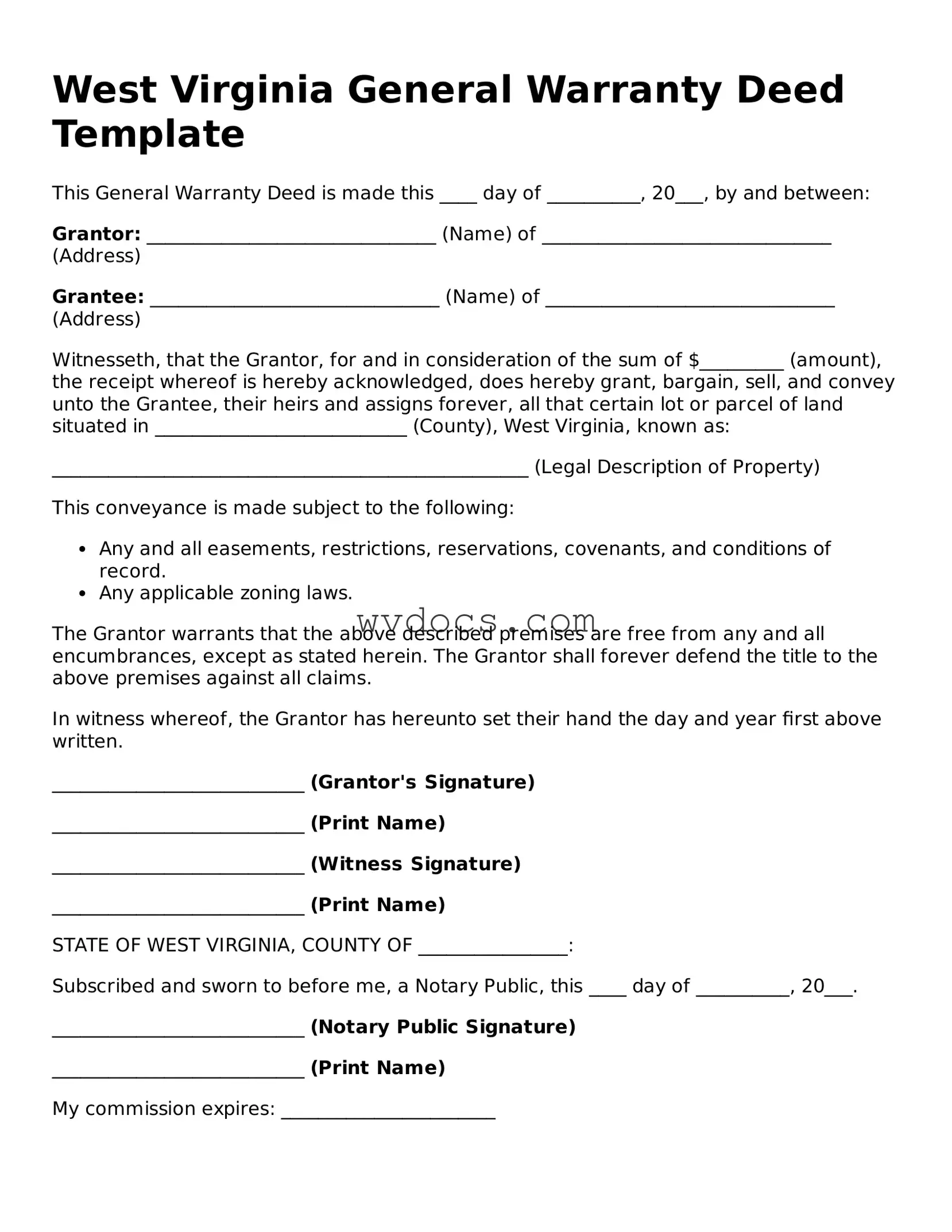

Preview - West Virginia Deed Form

West Virginia General Warranty Deed Template

This General Warranty Deed is made this ____ day of __________, 20___, by and between:

Grantor: _______________________________ (Name) of _______________________________ (Address)

Grantee: _______________________________ (Name) of _______________________________ (Address)

Witnesseth, that the Grantor, for and in consideration of the sum of $_________ (amount), the receipt whereof is hereby acknowledged, does hereby grant, bargain, sell, and convey unto the Grantee, their heirs and assigns forever, all that certain lot or parcel of land situated in ___________________________ (County), West Virginia, known as:

___________________________________________________ (Legal Description of Property)

This conveyance is made subject to the following:

- Any and all easements, restrictions, reservations, covenants, and conditions of record.

- Any applicable zoning laws.

The Grantor warrants that the above described premises are free from any and all encumbrances, except as stated herein. The Grantor shall forever defend the title to the above premises against all claims.

In witness whereof, the Grantor has hereunto set their hand the day and year first above written.

___________________________ (Grantor's Signature)

___________________________ (Print Name)

___________________________ (Witness Signature)

___________________________ (Print Name)

STATE OF WEST VIRGINIA, COUNTY OF ________________:

Subscribed and sworn to before me, a Notary Public, this ____ day of __________, 20___.

___________________________ (Notary Public Signature)

___________________________ (Print Name)

My commission expires: _______________________

Documents used along the form

When completing a property transaction in West Virginia, several additional forms and documents may be necessary alongside the Deed form. These documents help ensure that the transfer of ownership is clear and legally binding. Below is a list of common documents that are often used in conjunction with the Deed form.

- Title Search Report: This document provides a detailed examination of the property's title history. It reveals any claims, liens, or other encumbrances that may affect ownership.

- Affidavit of Title: A sworn statement by the seller confirming their ownership of the property and that there are no undisclosed liens or claims against it.

- Property Survey: A map that outlines the boundaries of the property. It helps clarify the exact size and location, which can prevent future disputes over property lines.

- Closing Statement: This document summarizes the financial aspects of the transaction, including the purchase price, closing costs, and any adjustments made. It provides a clear picture of what each party owes or is owed.

- Transfer Tax Form: A form that documents the transfer of property ownership and calculates any applicable transfer taxes. This is often required for recording the deed.

- Real Estate Purchase Agreement: This essential document, often utilized in property transactions, details the terms and conditions agreed upon by the buyer and seller. For more information, visit TopTemplates.info.

- Homeowner’s Association (HOA) Documents: If the property is part of an HOA, these documents outline the rules and regulations governing the community, as well as any fees associated with membership.

- Loan Documents: If financing is involved, these documents include the mortgage agreement and any related disclosures. They detail the terms of the loan and the responsibilities of both the lender and the borrower.

Each of these documents plays a critical role in the property transfer process. Understanding their purpose can help ensure a smoother transaction and provide peace of mind for all parties involved.