Valid West Virginia Durable Power of Attorney Document

Key takeaways

When considering the West Virginia Durable Power of Attorney (DPOA) form, it is essential to understand its implications and requirements. This legal document allows an individual, known as the principal, to designate another person, referred to as the agent, to make decisions on their behalf. Here are some key takeaways regarding the use and completion of this form:

- Purpose of the DPOA: The primary aim of a Durable Power of Attorney is to ensure that someone you trust can manage your financial and legal affairs if you become unable to do so yourself.

- Durability: Unlike a regular power of attorney, the "durable" aspect means that the authority granted remains effective even if the principal becomes incapacitated.

- Choosing an Agent: It is crucial to select someone who is reliable and trustworthy, as they will have significant control over your affairs. This person should understand your values and preferences.

- Specific Powers: The DPOA can be tailored to grant specific powers or broad authority. Clearly outline what decisions the agent can make, such as managing bank accounts or handling real estate transactions.

- Signing Requirements: To ensure the DPOA is legally valid, it must be signed by the principal in the presence of a notary public. Witnesses may also be required, depending on local laws.

- Revocation: The principal has the right to revoke the DPOA at any time, as long as they are mentally competent. This can be done by notifying the agent and any institutions relying on the document.

- Review and Update: Regularly review the DPOA to ensure it reflects your current wishes and circumstances. Life changes, such as marriage or divorce, may necessitate updates to the document.

Understanding these key points can empower individuals to make informed decisions regarding their Durable Power of Attorney in West Virginia. Properly executed, this document serves as a vital tool for managing one's affairs during times of need.

Other Common West Virginia Templates

How to Get Power of Attorney in Wv - Clarifies who can make legal decisions regarding your child.

When seeking a comprehensive understanding of how to craft an effective Recommendation Letter, resources like TopTemplates.info can be invaluable. These letters not only detail qualifications but also emphasize the individual's unique contributions and potential, making them an essential asset in various evaluation contexts.

Power of Attorney West Virginia - Make vehicle dealings easy by granting someone the legal power to act for you.

Misconceptions

Understanding the Durable Power of Attorney (DPOA) form in West Virginia is crucial for effective estate planning. However, several misconceptions can lead to confusion. Here are ten common misconceptions about this important legal document:

- It only applies to financial matters. Many people believe a DPOA is limited to financial decisions. In reality, it can also cover healthcare decisions if specified.

- It is only valid while the principal is alive. Some assume that a DPOA becomes invalid upon the principal's death. However, it ceases to be effective only after death, at which point a will or trust takes over.

- Anyone can be appointed as an agent. There is a misconception that any person can serve as an agent. In West Virginia, the agent must be an adult and of sound mind.

- A DPOA is permanent and cannot be revoked. This is incorrect. The principal can revoke a DPOA at any time as long as they are competent.

- All DPOAs are the same. Not all DPOA forms are identical. Each state has its own requirements and variations, and West Virginia is no exception.

- It has to be notarized to be valid. While notarization is recommended for a DPOA in West Virginia, it is not strictly required. Witness signatures can suffice in some cases.

- It becomes effective immediately. Some people think a DPOA is always effective right away. In fact, it can be set up to become effective only upon the principal's incapacitation.

- Once signed, it cannot be changed. This misconception overlooks the fact that the principal can modify the DPOA at any time, as long as they are mentally competent.

- Agents can do anything they want with the principal's assets. This is misleading. An agent has a fiduciary duty to act in the best interest of the principal and must follow their wishes.

- It is only necessary for the elderly. While often associated with older individuals, a DPOA is beneficial for anyone who wants to ensure their wishes are followed in case of incapacitation.

By understanding these misconceptions, individuals can make informed decisions regarding their Durable Power of Attorney and ensure their interests are protected.

Similar forms

The West Virginia Durable Power of Attorney (DPOA) form is similar to a General Power of Attorney (GPOA). Both documents allow individuals to appoint someone to act on their behalf in various matters. However, the key difference lies in the durability aspect. A GPOA becomes invalid if the principal becomes incapacitated, whereas a DPOA remains in effect even if the principal loses the ability to make decisions. This makes the DPOA particularly useful for long-term planning and ensuring that financial and healthcare decisions can continue to be managed by a trusted individual when needed.

Another document that shares similarities with the DPOA is the Healthcare Power of Attorney (HPOA). This specific form allows a person to designate someone to make medical decisions on their behalf if they are unable to do so. While the DPOA can cover financial and legal matters, the HPOA focuses solely on healthcare. Both documents empower an agent to act in the best interest of the principal, ensuring that their wishes are respected, whether in financial or medical contexts.

The Living Will is another document related to the DPOA. A Living Will outlines an individual's preferences regarding medical treatment in situations where they cannot communicate their wishes, particularly at the end of life. While the DPOA appoints someone to make decisions, the Living Will communicates the individual's specific desires about life-sustaining treatments. Together, these documents provide a comprehensive approach to healthcare planning, allowing individuals to express their wishes and appoint someone to advocate for them.

The Revocable Trust shares some characteristics with the DPOA in that both can be used for estate planning. A Revocable Trust allows individuals to place their assets into a trust during their lifetime, which can then be managed by a trustee. This can help avoid probate and ensure a smoother transfer of assets upon death. While the DPOA grants authority to manage financial matters, a Revocable Trust provides a structured way to manage and distribute assets, often with more control and flexibility.

The Financial Power of Attorney is closely related to the DPOA, as it specifically grants someone the authority to handle financial matters. While the DPOA can be broader in scope, encompassing both financial and healthcare decisions, the Financial Power of Attorney focuses solely on financial affairs. This includes managing bank accounts, paying bills, and making investment decisions. Both documents are crucial for ensuring that financial responsibilities are handled appropriately, especially in cases of incapacity.

For those interested in starting a corporation in Florida, it is essential to file the appropriate documentation, including the Articles of Incorporation form, which provides the necessary framework for legal recognition and operational structure within the state.

Similarly, the Special Power of Attorney allows individuals to grant limited authority to someone for specific tasks. Unlike the DPOA, which is often comprehensive, the Special Power of Attorney is tailored for particular actions, such as selling a property or managing a specific investment. This document can complement a DPOA by providing targeted authority while still ensuring that someone can act on behalf of the principal when necessary.

The Advance Directive is another document that aligns with the DPOA, particularly in the realm of healthcare. An Advance Directive encompasses both the Living Will and the Healthcare Power of Attorney, allowing individuals to outline their healthcare preferences and appoint someone to make decisions on their behalf. This comprehensive approach ensures that an individual’s medical wishes are honored and that a trusted person is available to make decisions when they cannot advocate for themselves.

The Guardianship Petition is related to the DPOA in that it involves appointing someone to make decisions for an individual, but it typically arises when someone is unable to care for themselves and has not established a DPOA. In such cases, a court appoints a guardian to oversee the personal and financial affairs of the incapacitated individual. This process can be more complex and time-consuming than utilizing a DPOA, which allows individuals to preemptively designate their preferred decision-maker.

Lastly, the Will is another important document in the realm of estate planning that, while not directly similar to the DPOA, serves a complementary purpose. A Will outlines how an individual's assets will be distributed after their death. While the DPOA is concerned with decision-making during the individual’s lifetime, the Will addresses what happens after they pass away. Together, these documents help ensure that a person’s wishes are honored both during their life and after their death.

Key Facts about West Virginia Durable Power of Attorney

What is a Durable Power of Attorney in West Virginia?

A Durable Power of Attorney (DPOA) is a legal document that allows an individual, known as the principal, to designate another person, called the agent or attorney-in-fact, to make decisions on their behalf. This authority remains in effect even if the principal becomes incapacitated, ensuring that their financial and medical matters can be managed without interruption.

Why should I consider creating a Durable Power of Attorney?

Creating a DPOA can provide peace of mind. It allows you to choose someone you trust to handle your affairs if you are unable to do so. This can be particularly important in situations involving serious illness or accidents. Without a DPOA, your loved ones may face difficulties managing your affairs, potentially leading to costly and time-consuming court proceedings.

Who can be appointed as an agent in a Durable Power of Attorney?

In West Virginia, you can appoint any competent adult as your agent. This could be a family member, friend, or even a professional, such as an attorney or accountant. It is crucial to select someone who is trustworthy and capable of making decisions that align with your values and wishes.

What powers can I grant to my agent through a Durable Power of Attorney?

The powers granted in a DPOA can be broad or limited, depending on your preferences. You may allow your agent to manage financial matters, such as paying bills, handling investments, or selling property. Alternatively, you can specify certain powers, such as only allowing them to manage specific accounts or transactions. It is essential to be clear about what powers you wish to grant.

Does a Durable Power of Attorney need to be notarized?

Yes, in West Virginia, a Durable Power of Attorney must be signed in the presence of a notary public to be considered valid. Notarization helps to ensure that the document is authentic and that the principal was competent and willing to sign it. Additionally, witnesses may also be required, depending on the specific provisions of the document.

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a DPOA at any time as long as you are mentally competent. To do so, you should create a written revocation document and notify your agent and any relevant institutions or individuals who may have relied on the original DPOA. It is advisable to keep a copy of the revocation for your records.

What happens if I do not have a Durable Power of Attorney?

If you do not have a DPOA and become incapacitated, your family may need to seek a court-appointed guardian or conservator to manage your affairs. This process can be lengthy, expensive, and may not align with your wishes. Having a DPOA in place can help avoid these complications and ensure your preferences are respected.

Is a Durable Power of Attorney only for financial matters?

No, a Durable Power of Attorney can cover both financial and healthcare decisions. You can create a separate document for healthcare decisions, often called a Health Care Power of Attorney, or include healthcare powers in your DPOA. This flexibility allows you to ensure that your medical preferences are honored in addition to your financial interests.

Can I use a Durable Power of Attorney created in another state in West Virginia?

Generally, a DPOA created in another state may be recognized in West Virginia, but it must comply with West Virginia laws to be effective. It is advisable to consult with a local attorney to ensure that the document meets all necessary requirements and adequately protects your interests.

How can I ensure my Durable Power of Attorney is effective?

To ensure your DPOA is effective, make sure it is properly executed according to West Virginia law, including notarization and any required witnesses. Keep the document in a safe place and provide copies to your agent, healthcare providers, and financial institutions. Regularly review the document to ensure it still reflects your wishes and circumstances.

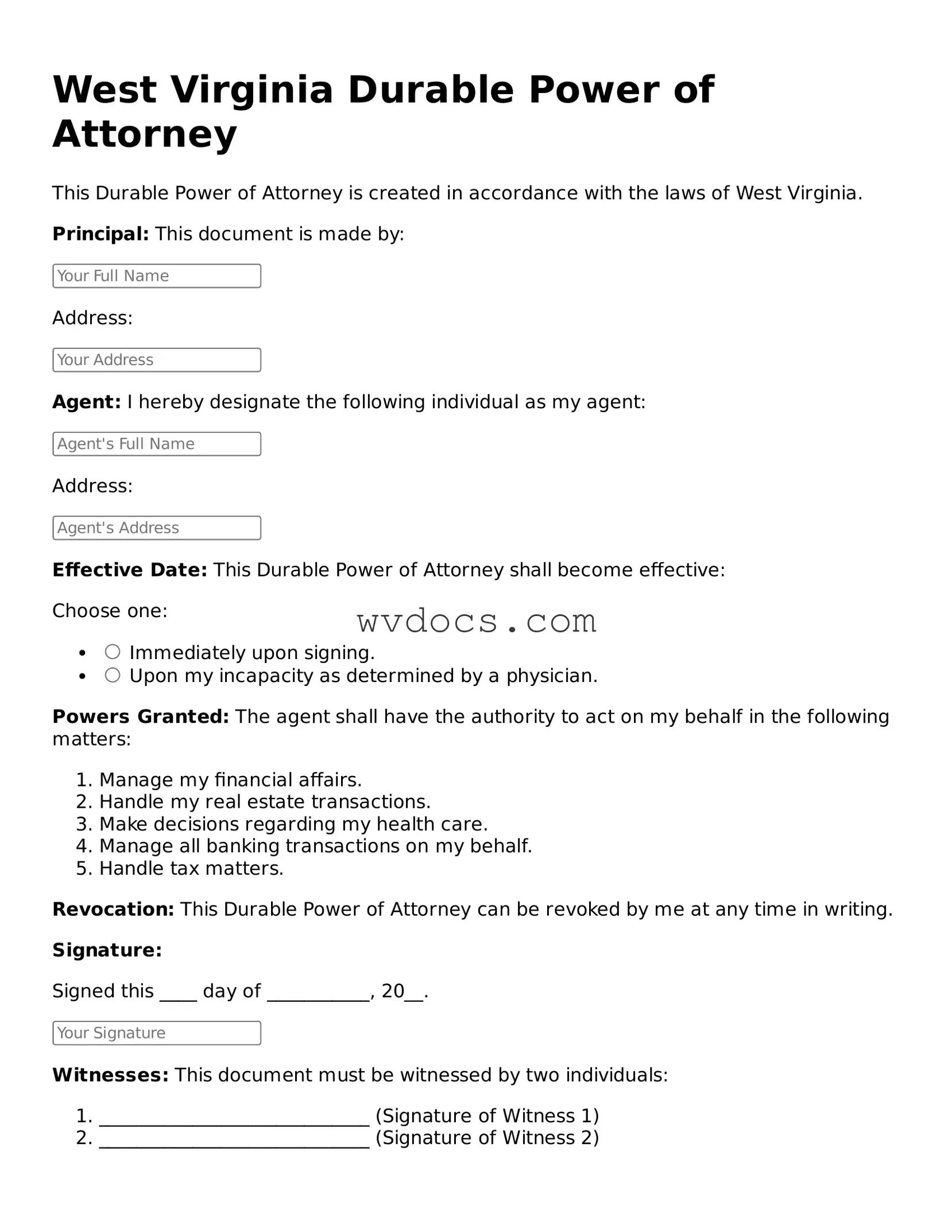

Preview - West Virginia Durable Power of Attorney Form

West Virginia Durable Power of Attorney

This Durable Power of Attorney is created in accordance with the laws of West Virginia.

Principal: This document is made by:

Address:

Agent: I hereby designate the following individual as my agent:

Address:

Effective Date: This Durable Power of Attorney shall become effective:

Choose one:

- Immediately upon signing.

- Upon my incapacity as determined by a physician.

Powers Granted: The agent shall have the authority to act on my behalf in the following matters:

- Manage my financial affairs.

- Handle my real estate transactions.

- Make decisions regarding my health care.

- Manage all banking transactions on my behalf.

- Handle tax matters.

Revocation: This Durable Power of Attorney can be revoked by me at any time in writing.

Signature:

Signed this ____ day of ___________, 20__.

Witnesses: This document must be witnessed by two individuals:

- _____________________________ (Signature of Witness 1)

- _____________________________ (Signature of Witness 2)

Notarization:

State of West Virginia, County of ____________:

On this ____ day of ___________, 20__, before me, a notary public, personally appeared __________________________, the principal, known to me to be the person whose name is signed above.

__________________________ (Notary Public Signature)

Documents used along the form

The West Virginia Durable Power of Attorney form serves as a crucial legal document, allowing an individual to designate someone else to make decisions on their behalf. This form is often accompanied by various other documents that can enhance its effectiveness or address related legal matters. Below is a list of commonly used forms and documents that may accompany the Durable Power of Attorney.

- Advance Healthcare Directive: This document outlines an individual's healthcare preferences in case they become unable to communicate their wishes. It typically includes instructions regarding medical treatments and the designation of a healthcare proxy.

- Living Will: A living will specifies the types of medical treatments an individual wishes to receive or avoid in situations where they cannot express their wishes. It focuses on end-of-life care and can guide healthcare providers and family members.

- Financial Power of Attorney: Similar to the Durable Power of Attorney, this document specifically grants authority to manage financial matters. It may be used for transactions such as banking, real estate, and investments.

- Revocation of Power of Attorney: This form is used to officially cancel a previously granted Power of Attorney. It ensures that the designated agent no longer has authority to act on behalf of the principal.

- Power of Attorney for a Child Form: For parents seeking temporary authority, the comprehensive Power of Attorney for a Child documentation allows another adult to make decisions in their absence.

- Trust Document: A trust document outlines the terms of a trust, which can manage assets during an individual's lifetime and after death. It can work in tandem with a Durable Power of Attorney for comprehensive estate planning.

- Guardianship Petition: If an individual becomes incapacitated without a Durable Power of Attorney, a guardianship petition may be filed to appoint someone to make decisions on their behalf. This process is often more complex and time-consuming.

- Estate Plan: An estate plan includes various documents such as wills, trusts, and powers of attorney. It provides a comprehensive strategy for managing an individual's assets and healthcare wishes both during their life and after death.

- HIPAA Release Form: This document allows designated individuals to access a person's medical records and make healthcare decisions. It is essential for ensuring that the appointed agent can communicate effectively with healthcare providers.

- Beneficiary Designation Forms: These forms specify who will receive certain assets, such as life insurance policies or retirement accounts, upon the individual's death. They are crucial for ensuring that assets are distributed according to the individual's wishes.

Each of these documents plays a significant role in ensuring that an individual's wishes are respected and followed, especially in times of incapacity or uncertainty. Together, they create a robust framework for managing both healthcare and financial decisions, providing peace of mind for both the individual and their loved ones.