Valid West Virginia Last Will and Testament Document

Key takeaways

Filling out a Last Will and Testament form in West Virginia is an important step in ensuring that your wishes are honored after your passing. Here are some key takeaways to consider:

- Understand the Purpose: A Last Will and Testament outlines how you want your assets distributed and who will manage your estate after you pass away.

- Eligibility: You must be at least 18 years old and of sound mind to create a valid will in West Virginia.

- Choose an Executor: Select a trustworthy individual to act as your executor. This person will be responsible for carrying out the instructions in your will.

- Detail Your Assets: Clearly list your assets and specify who will receive each item. This can include property, bank accounts, and personal belongings.

- Consider Guardianship: If you have minor children, appoint a guardian to care for them in the event of your passing.

- Sign and Date: Ensure that you sign and date the will in the presence of at least two witnesses who are not beneficiaries.

- Witness Requirements: The witnesses must be at least 18 years old and should not have any stake in your estate.

- Keep it Safe: Store your will in a secure location, such as a safe deposit box or with a trusted family member, and inform your executor of its location.

- Review Regularly: Life changes, such as marriage, divorce, or the birth of children, may necessitate updates to your will.

- Legal Assistance: While it’s possible to create a will on your own, consulting with a legal professional can help ensure that your will meets all state requirements.

By keeping these takeaways in mind, you can create a Last Will and Testament that reflects your wishes and provides peace of mind for you and your loved ones.

Other Common West Virginia Templates

How to Create an Employee Handbook - This handbook serves as a comprehensive guide for all employees regarding company policies and procedures.

For those looking to navigate the complexities of private sales, utilizing a reliable resource can make the process much smoother, such as the toptemplates.info/bill-of-sale/california-bill-of-sale/, which provides a template for the necessary California Bill of Sale form, ensuring that all essential details are included to safeguard both the buyer and seller.

Wv Divorce Property Settlement Agreement - It marks a formal end to marital obligations in many areas.

Misconceptions

Understanding the Last Will and Testament form in West Virginia is crucial for ensuring your wishes are honored after your passing. Here are seven common misconceptions about this important legal document:

-

All wills must be notarized.

In West Virginia, while notarization can add an extra layer of validation, it is not a requirement for a will to be valid. Witness signatures are what truly matter.

-

Only lawyers can create a will.

While it’s advisable to consult a lawyer for complex estates, individuals can create their own wills using the appropriate forms, provided they follow state laws.

-

Oral wills are always valid.

Oral wills, also known as nuncupative wills, are not recognized in West Virginia, except under very specific circumstances, such as for military personnel.

-

Once a will is made, it cannot be changed.

This is false. Wills can be amended or revoked at any time, as long as the person is of sound mind and follows the proper procedures.

-

Beneficiaries must be family members.

In West Virginia, you can name anyone as a beneficiary in your will, including friends, charities, or organizations.

-

Wills are only for wealthy individuals.

Everyone, regardless of their financial situation, should have a will to ensure their wishes are carried out and to avoid potential disputes.

-

All debts must be paid before any distributions are made.

While debts need to be settled, the timing and method of distribution can vary based on the estate's circumstances and the executor's decisions.

Clarifying these misconceptions can help individuals better prepare their estate plans and ensure their wishes are respected. It’s important to be informed and proactive in this process.

Similar forms

The West Virginia Last Will and Testament form shares similarities with a Living Will. A Living Will is a legal document that outlines a person's preferences regarding medical treatment in the event they become incapacitated. While a Last Will and Testament addresses the distribution of a person's assets after death, a Living Will focuses on healthcare decisions during life. Both documents reflect an individual's wishes and intentions, ensuring that their preferences are honored, whether concerning property or medical care.

For those considering purchasing or selling an ATV, it's important to document the transaction properly. The New York ATV Bill of Sale form is essential for recording the sale and ensuring that both the buyer and seller are protected under state law. To facilitate this process, you can find a useful template at smarttemplates.net, which simplifies the creation of this important document.

Another document that parallels the Last Will and Testament is a Durable Power of Attorney. This legal instrument allows an individual to appoint someone to make decisions on their behalf if they become unable to do so. Like a Last Will, a Durable Power of Attorney is concerned with the management of personal affairs, but it operates during a person's lifetime rather than after death. Both documents empower individuals to designate trusted agents to carry out their wishes, providing a framework for decision-making in critical situations.

The Revocable Trust is also similar to the Last Will and Testament in that it addresses the distribution of assets. A Revocable Trust allows individuals to transfer their assets into a trust during their lifetime, which can then be managed and distributed according to their wishes upon death. Unlike a Last Will, which must go through probate, a Revocable Trust can facilitate a smoother transition of assets, avoiding the probate process altogether. Both documents serve to ensure that an individual's estate is handled according to their desires.

A Healthcare Proxy is another document that bears resemblance to the Last Will and Testament. This legal instrument designates an individual to make healthcare decisions on behalf of another person if they are unable to do so. While the Last Will pertains to the distribution of property after death, the Healthcare Proxy addresses medical decisions during life. Both documents emphasize the importance of personal choice and the need for trusted individuals to act in accordance with one's wishes.

The Codicil is a modification document that serves as an amendment to an existing Last Will and Testament. It allows individuals to make changes to their will without having to create an entirely new document. A Codicil can add, revoke, or alter provisions of the original will, maintaining the individual's intent while accommodating changes in circumstances. Like the Last Will, a Codicil must meet specific legal requirements to ensure its validity, reinforcing the significance of clear and updated estate planning.

Lastly, the Letter of Instruction is often considered a companion document to a Last Will and Testament. While the Last Will provides legal directives for asset distribution, the Letter of Instruction offers personal guidance to the executor or family members. It may include details about funeral arrangements, personal wishes, and information about accounts and assets. This document serves to clarify the individual's intentions and provide additional context, enhancing the effectiveness of the Last Will in carrying out the person's desires.

Key Facts about West Virginia Last Will and Testament

What is a Last Will and Testament?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their death. It allows individuals to specify who will inherit their property, appoint guardians for minor children, and designate an executor to manage the estate.

Why do I need a Last Will and Testament in West Virginia?

Having a Last Will and Testament is essential for ensuring that your wishes are honored after your passing. Without a will, the state of West Virginia will determine how your assets are distributed, which may not align with your preferences. A will provides clarity and can help avoid disputes among family members.

Who can create a Last Will and Testament in West Virginia?

In West Virginia, any person who is at least 18 years old and of sound mind can create a Last Will and Testament. It is important that the individual understands the nature of their actions and the implications of their decisions when drafting the will.

What are the requirements for a valid Last Will and Testament in West Virginia?

To be valid, a Last Will and Testament in West Virginia must be in writing and signed by the testator (the person making the will). Additionally, it must be witnessed by at least two individuals who are not beneficiaries of the will. These witnesses must also sign the document in the presence of the testator.

Can I change or revoke my Last Will and Testament?

Yes, you can change or revoke your Last Will and Testament at any time while you are alive and competent. To make changes, you can create a new will or add a codicil, which is an amendment to the existing will. Revocation can be done by destroying the old will or explicitly stating your intention to revoke it.

What happens if I die without a will in West Virginia?

If you die without a will, your estate will be distributed according to West Virginia's intestacy laws. This means that your assets will be divided among your relatives according to a predetermined order, which may not reflect your personal wishes. This can lead to complications and potential disputes among family members.

How can I ensure my Last Will and Testament is executed properly?

To ensure proper execution, it is advisable to consult with an attorney who specializes in estate planning. They can help you draft a will that meets all legal requirements and reflects your intentions. Additionally, keep your will in a safe place and inform your executor and family members of its location.

What is the role of an executor in a Last Will and Testament?

The executor is the person designated in the will to manage the deceased's estate. Their responsibilities include gathering assets, paying debts and taxes, and distributing the remaining assets according to the will. It is crucial to choose someone trustworthy and organized for this role.

Can I include specific gifts in my Last Will and Testament?

Yes, you can include specific gifts in your will. This means you can designate particular items or amounts of money to specific individuals. Clearly describing these gifts in the will can help prevent confusion or disputes among beneficiaries.

Is it necessary to have a lawyer to create a Last Will and Testament?

While it is not legally required to have a lawyer to create a will, it is highly recommended. A lawyer can ensure that your will complies with state laws and accurately reflects your wishes. They can also provide guidance on complex issues, such as tax implications and guardianship arrangements.

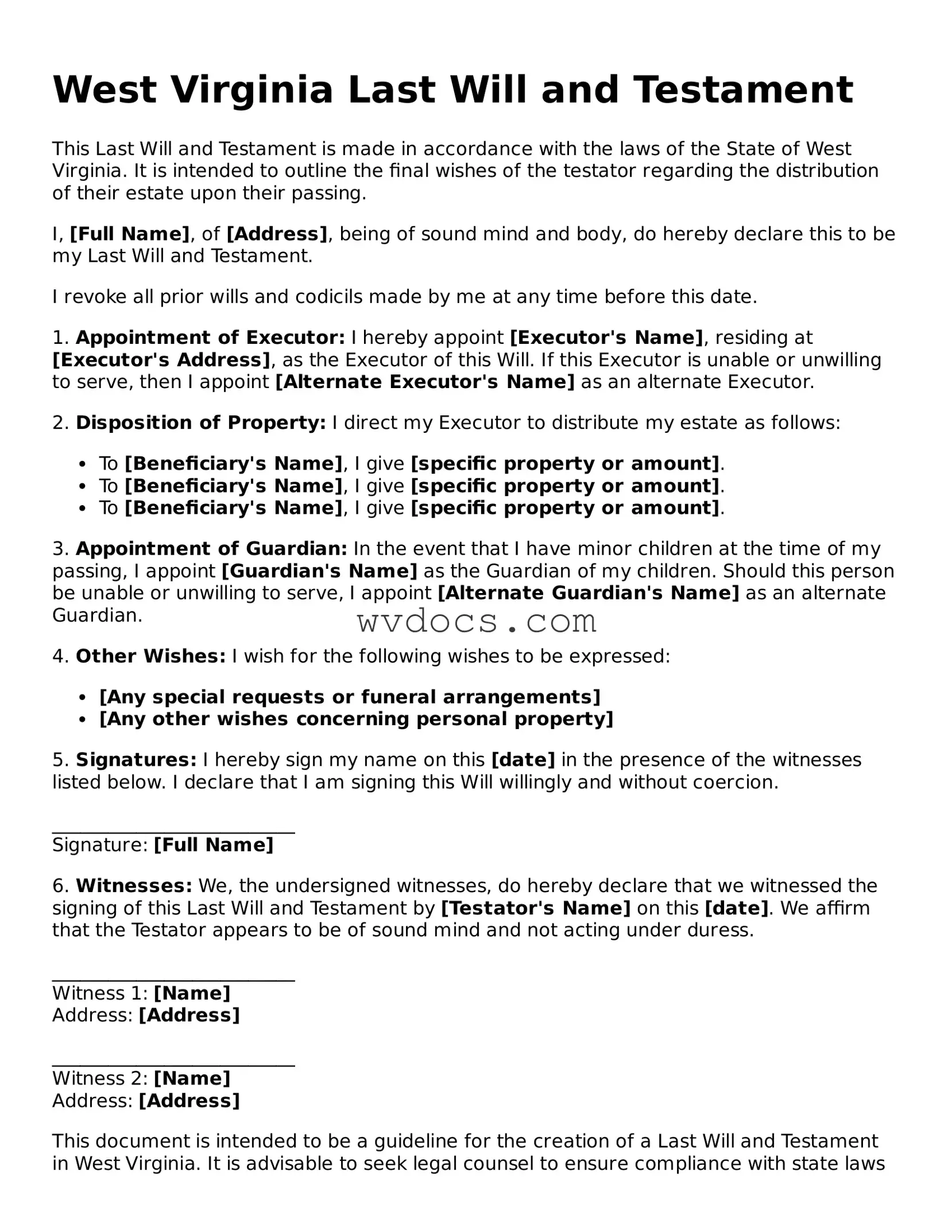

Preview - West Virginia Last Will and Testament Form

West Virginia Last Will and Testament

This Last Will and Testament is made in accordance with the laws of the State of West Virginia. It is intended to outline the final wishes of the testator regarding the distribution of their estate upon their passing.

I, [Full Name], of [Address], being of sound mind and body, do hereby declare this to be my Last Will and Testament.

I revoke all prior wills and codicils made by me at any time before this date.

1. Appointment of Executor: I hereby appoint [Executor's Name], residing at [Executor's Address], as the Executor of this Will. If this Executor is unable or unwilling to serve, then I appoint [Alternate Executor's Name] as an alternate Executor.

2. Disposition of Property: I direct my Executor to distribute my estate as follows:

- To [Beneficiary's Name], I give [specific property or amount].

- To [Beneficiary's Name], I give [specific property or amount].

- To [Beneficiary's Name], I give [specific property or amount].

3. Appointment of Guardian: In the event that I have minor children at the time of my passing, I appoint [Guardian's Name] as the Guardian of my children. Should this person be unable or unwilling to serve, I appoint [Alternate Guardian's Name] as an alternate Guardian.

4. Other Wishes: I wish for the following wishes to be expressed:

- [Any special requests or funeral arrangements]

- [Any other wishes concerning personal property]

5. Signatures: I hereby sign my name on this [date] in the presence of the witnesses listed below. I declare that I am signing this Will willingly and without coercion.

__________________________

Signature: [Full Name]

6. Witnesses: We, the undersigned witnesses, do hereby declare that we witnessed the signing of this Last Will and Testament by [Testator's Name] on this [date]. We affirm that the Testator appears to be of sound mind and not acting under duress.

__________________________

Witness 1: [Name]

Address: [Address]

__________________________

Witness 2: [Name]

Address: [Address]

This document is intended to be a guideline for the creation of a Last Will and Testament in West Virginia. It is advisable to seek legal counsel to ensure compliance with state laws and personal circumstances.

Documents used along the form

When preparing a Last Will and Testament in West Virginia, it’s often beneficial to consider additional documents that can support your estate planning efforts. These documents can help clarify your intentions and ensure your wishes are honored after your passing. Below is a list of commonly used forms and documents that complement a will.

- Durable Power of Attorney: This document allows you to designate someone to make financial and legal decisions on your behalf if you become incapacitated. It remains effective even if you are unable to communicate your wishes.

- LLC Operating Agreement: To ensure a solid framework for your business, consider utilizing the essential Florida Operating Agreement form resources to outline the management structure and operational guidelines for your LLC.

- Healthcare Power of Attorney: Similar to a durable power of attorney, this form specifically allows you to appoint someone to make medical decisions for you when you are unable to do so. It ensures your healthcare preferences are respected.

- Living Will: A living will outlines your preferences regarding medical treatment in situations where you are unable to express your wishes, particularly in end-of-life scenarios. This document can provide clarity to your loved ones and healthcare providers.

- Revocable Living Trust: This trust holds your assets during your lifetime and can help avoid probate after your death. It allows for a smooth transition of your assets to beneficiaries while maintaining privacy and control over your estate.

- Beneficiary Designations: Certain assets, like life insurance policies and retirement accounts, allow you to name beneficiaries directly. Ensuring these designations are up-to-date can simplify the distribution of your assets.

- Letter of Instruction: While not a legally binding document, this letter provides additional guidance to your executor or loved ones. It can include details about your funeral wishes, the location of important documents, and other personal messages.

- Codicil: A codicil is an amendment to your existing will. If you need to make changes to your will after it has been executed, a codicil allows you to do so without creating an entirely new document.

- Pet Trust: If you have pets, a pet trust ensures that they will be cared for according to your wishes after your passing. This document can specify how funds should be used for their care and who will be responsible for them.

Incorporating these documents into your estate planning can provide peace of mind and clarity for both you and your loved ones. Each document serves a specific purpose, and together they can create a comprehensive plan that reflects your wishes and protects your interests.