Valid West Virginia Promissory Note Document

Key takeaways

When filling out and using the West Virginia Promissory Note form, keep these key takeaways in mind:

- Identify the parties clearly: Include the full names and addresses of both the borrower and the lender. This ensures that all parties are easily identifiable in the agreement.

- Specify the loan amount: Clearly state the principal amount being borrowed. This figure should be accurate to avoid any confusion later.

- Outline repayment terms: Include details about the repayment schedule, interest rate, and due dates. Clarity in these terms helps prevent disputes.

- Include signatures: Both parties must sign the document. This step is crucial as it signifies agreement to the terms outlined in the note.

Other Common West Virginia Templates

Wv Lease - Understanding the specifics of a Lease Agreement can enhance a tenant's overall rental experience.

To ensure a smooth application process, applicants should complete the necessary paperwork and include the Arizona University Application form if they qualify for a fee waiver, as this will help alleviate financial burdens while striving for admission to esteemed institutions such as Arizona State University, Northern Arizona University, and the University of Arizona.

Wv Living Will - A Living Will is key for those who want to maintain control over their medical decisions.

How to Create an Employee Handbook - This handbook emphasizes the importance of adherence to the company's code of conduct at all times.

Misconceptions

Understanding the West Virginia Promissory Note form is crucial for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here are six common misunderstandings:

- It must be notarized. Many believe that a promissory note in West Virginia requires notarization to be valid. In reality, while notarization can provide an extra layer of authenticity, it is not a legal requirement for the note to be enforceable.

- Only banks can issue promissory notes. This is incorrect. Individuals can create and sign promissory notes. They are not limited to financial institutions, making them accessible for personal loans between friends and family.

- All promissory notes are the same. Not all promissory notes are identical. They can vary significantly based on terms, interest rates, and repayment schedules. Tailoring the document to fit specific agreements is essential for clarity and enforceability.

- Promissory notes are only for large amounts. Some think promissory notes are only necessary for significant loans. However, they can be used for any amount, regardless of size, as long as the parties agree on the terms.

- Verbal agreements are sufficient. While verbal agreements can be binding, they are often hard to enforce. A written promissory note provides clear evidence of the agreement and its terms, reducing the risk of disputes.

- They do not need to include interest. Some assume that a promissory note cannot include interest. In fact, it is common for these notes to specify an interest rate, which can be beneficial for both parties involved.

By addressing these misconceptions, individuals can better navigate the complexities of promissory notes in West Virginia and ensure their financial agreements are clear and legally sound.

Similar forms

A loan agreement is a document that outlines the terms of a loan between a lender and a borrower. Similar to a promissory note, it specifies the amount borrowed, interest rates, and repayment terms. However, a loan agreement often includes more detailed provisions regarding collateral, default conditions, and the responsibilities of both parties. This makes it a more comprehensive document than a simple promissory note.

A mortgage is another document that shares similarities with a promissory note. While a promissory note represents the borrower’s promise to repay a loan, a mortgage secures that loan with the property being purchased. In essence, the mortgage provides the lender with a legal claim to the property if the borrower fails to make payments, making it a crucial part of real estate transactions.

An IOU, or "I owe you," is a less formal document that acknowledges a debt. Like a promissory note, it signifies that one party owes money to another. However, an IOU typically lacks the detailed terms of repayment and interest rates found in a promissory note. It serves more as a simple acknowledgment of debt rather than a formal agreement.

A personal guarantee is a document where an individual agrees to repay a loan if the primary borrower defaults. This is similar to a promissory note in that it involves a commitment to repay a debt. However, a personal guarantee often extends beyond a single loan, covering multiple debts or obligations, thus providing additional security for the lender.

The New York ATV Bill of Sale form is essential for ensuring a smooth transaction when transferring ownership of an all-terrain vehicle. By documenting key details such as the ATV's description, sale price, and the identities of the buyer and seller, this form not only validates the sale but also assists in the vehicle registration process. For those looking to create a comprehensive and legally sound Bill of Sale, resources like smarttemplates.net can provide valuable templates and guidance.

A business loan agreement is tailored for commercial purposes and shares many elements with a promissory note. It includes the loan amount, interest rate, and repayment schedule, but also addresses business-specific terms, such as the use of funds and covenants that the business must adhere to. This makes it more complex and suited for business transactions.

A car loan agreement is specifically designed for financing the purchase of a vehicle. Like a promissory note, it details the loan amount and repayment terms. However, it also includes specific information about the vehicle being purchased and often incorporates clauses related to repossession if payments are not made, making it unique to auto financing.

A student loan agreement is similar to a promissory note but is specifically for educational expenses. It outlines the loan amount, interest rates, and repayment terms, just like a promissory note. However, it often includes additional provisions regarding deferment, grace periods, and specific repayment plans tailored for students, reflecting the unique nature of educational financing.

Key Facts about West Virginia Promissory Note

What is a West Virginia Promissory Note?

A West Virginia Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender. This note includes essential details such as the loan amount, interest rate, repayment schedule, and any applicable fees. It serves as a binding agreement between the parties involved and can be used in court if necessary.

Who can use a Promissory Note in West Virginia?

Anyone can use a Promissory Note in West Virginia, provided they are entering into a loan agreement. This includes individuals, businesses, and organizations. It is important that both the borrower and the lender understand the terms of the note before signing, as it holds legal significance.

What are the key components of a West Virginia Promissory Note?

A typical Promissory Note in West Virginia includes several key components. These are the names and addresses of the borrower and lender, the principal amount of the loan, the interest rate, the repayment schedule, and any late fees or penalties. Additionally, it may contain clauses regarding default and remedies available to the lender.

Is a Promissory Note legally binding in West Virginia?

Yes, a properly executed Promissory Note is legally binding in West Virginia. Once both parties sign the document, they are obligated to adhere to its terms. If the borrower fails to repay the loan as agreed, the lender has the right to take legal action to recover the owed amount.

Do I need a lawyer to create a Promissory Note in West Virginia?

While it is not required to have a lawyer to create a Promissory Note, consulting with one is advisable. A legal professional can help ensure that the document meets all legal requirements and adequately protects your interests. This is especially important for larger loans or complex agreements.

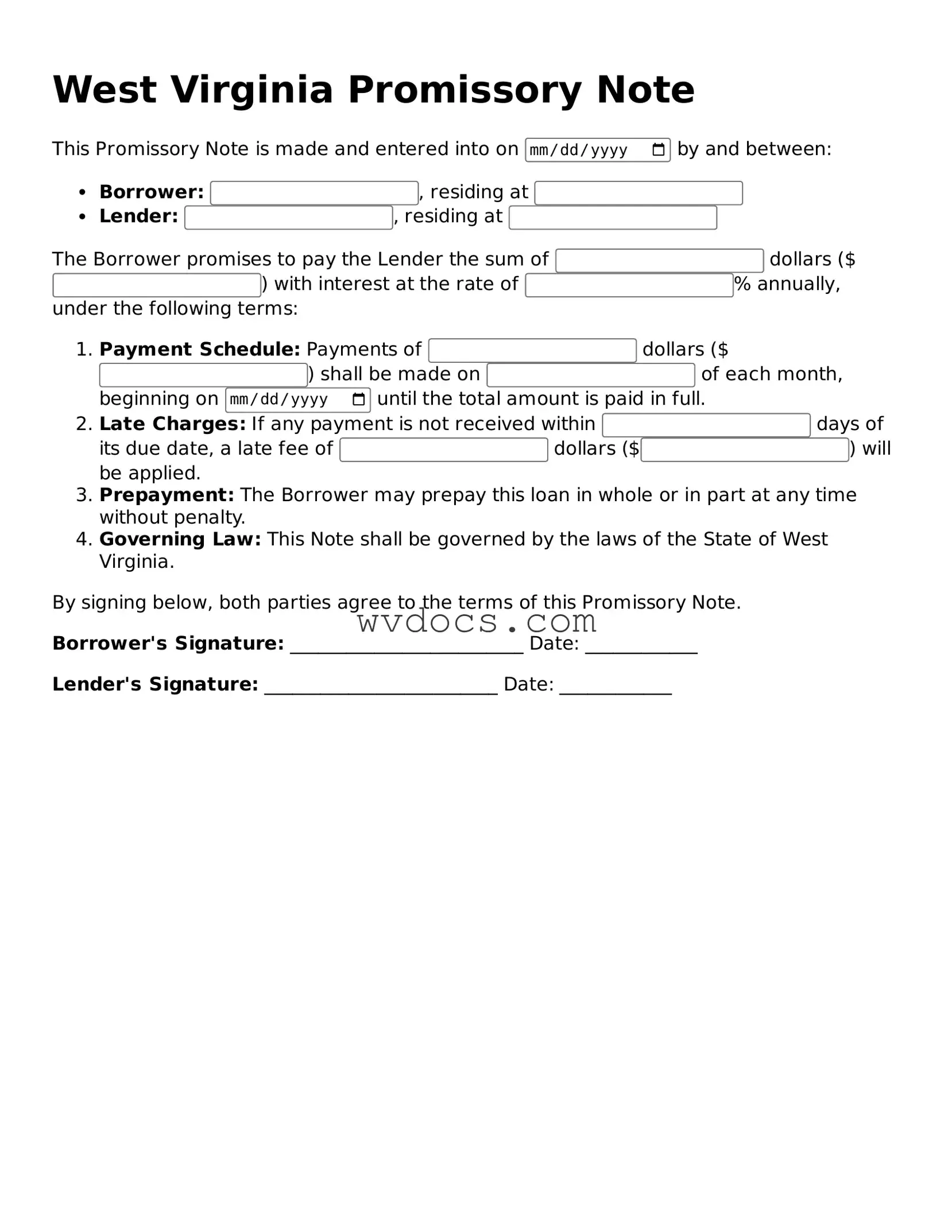

Preview - West Virginia Promissory Note Form

West Virginia Promissory Note

This Promissory Note is made and entered into on by and between:

- Borrower: , residing at

- Lender: , residing at

The Borrower promises to pay the Lender the sum of dollars ($) with interest at the rate of % annually, under the following terms:

- Payment Schedule: Payments of dollars ($) shall be made on of each month, beginning on until the total amount is paid in full.

- Late Charges: If any payment is not received within days of its due date, a late fee of dollars ($) will be applied.

- Prepayment: The Borrower may prepay this loan in whole or in part at any time without penalty.

- Governing Law: This Note shall be governed by the laws of the State of West Virginia.

By signing below, both parties agree to the terms of this Promissory Note.

Borrower's Signature: _________________________ Date: ____________

Lender's Signature: _________________________ Date: ____________

Documents used along the form

When dealing with a West Virginia Promissory Note, several other documents and forms may be used to ensure clarity and legal protection for all parties involved. Each of these documents serves a specific purpose and can help facilitate the lending process. Here’s a list of commonly associated forms:

- Loan Agreement: This document outlines the terms of the loan, including the amount, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide for both the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this agreement details the specific assets pledged as security. It protects the lender's interests in case of default.

- Power of Attorney for a Child Form: To delegate parental authority responsibly, utilize the temporary Power of Attorney for a Child document to ensure care for your child in your absence.

- Personal Guarantee: This form may be required if a business is borrowing money. It holds the individual personally responsible for the loan, adding an extra layer of security for the lender.

- Disclosure Statement: This document provides the borrower with important information about the loan, including fees, terms, and the total cost of borrowing. Transparency is key in lending.

- Amortization Schedule: This schedule outlines each payment due over the life of the loan, showing how much goes toward principal and interest. It helps borrowers understand their repayment obligations.

- Loan Modification Agreement: If changes to the original loan terms are necessary, this document formally amends the existing agreement. It ensures all parties are aware of and agree to the new terms.

- Default Notice: In the event of missed payments, this notice informs the borrower of their default status and the potential consequences. It serves as a formal warning before further action is taken.

- Release of Liability: Once the loan is fully repaid, this document releases the borrower from any further obligations. It provides proof that the debt has been settled.

Understanding these documents can help both lenders and borrowers navigate the lending process more effectively. Always consider seeking legal advice to ensure that all agreements are properly drafted and compliant with state laws.