Valid West Virginia Quitclaim Deed Document

Key takeaways

- Understand the Purpose: A quitclaim deed transfers ownership of property without guaranteeing that the title is clear. It is often used between family members or in situations where the parties trust each other.

- Gather Necessary Information: Before filling out the form, collect details such as the names of the grantor (the person giving up their interest) and the grantee (the person receiving the interest), as well as a description of the property.

- Complete the Form Accurately: Fill out the quitclaim deed form carefully. Ensure that all names are spelled correctly and that the property description is precise to avoid future disputes.

- Sign in Front of a Notary: The deed must be signed by the grantor in the presence of a notary public. This step is crucial for the deed to be legally valid.

- File with the County Clerk: After notarization, submit the quitclaim deed to the county clerk’s office where the property is located. This filing officially updates the public record.

- Keep Copies: Retain copies of the signed and filed quitclaim deed for your records. This documentation is important for future reference and can help resolve any potential issues.

Other Common West Virginia Templates

Buying a House on Contract Template - Covers potential seller financing arrangements if applicable.

For those seeking guidance on child care in the absence of a parent, the temporary Power of Attorney for a Child document serves as a crucial resource, detailing how to delegate parental responsibilities effectively.

Transfer on Death Deed Wv - It is essential to verify that the Transfer-on-Death Deed complies with state laws, as requirements may vary.

Misconceptions

Understanding the West Virginia Quitclaim Deed form is essential for anyone involved in property transactions. However, several misconceptions can lead to confusion. Here are ten common misconceptions:

- A Quitclaim Deed transfers ownership completely. This is not true. A Quitclaim Deed transfers the interest the grantor has in the property, but it does not guarantee that the grantor has full ownership or clear title.

- Quitclaim Deeds are only for divorces or family transactions. While often used in these situations, Quitclaim Deeds can be used for any transfer of property interest.

- A Quitclaim Deed provides a warranty of title. This is incorrect. Quitclaim Deeds do not come with warranties. The buyer assumes all risks regarding the title.

- You cannot use a Quitclaim Deed for real estate transactions. This is a misconception. Quitclaim Deeds are valid for transferring real estate, but they may not be the best choice for every situation.

- All states have the same Quitclaim Deed laws. Each state has its own regulations regarding Quitclaim Deeds. West Virginia has specific requirements that differ from other states.

- Using a Quitclaim Deed is a quick and easy way to transfer property. While it may seem straightforward, it is essential to understand the implications and potential legal issues that may arise.

- A Quitclaim Deed eliminates the need for title insurance. This is not accurate. Title insurance can still be necessary to protect against any claims or issues that arise after the transfer.

- Once a Quitclaim Deed is signed, it cannot be revoked. A Quitclaim Deed can be revoked or contested under certain circumstances, especially if fraud or coercion is involved.

- You do not need to record a Quitclaim Deed. Recording the deed is crucial. It provides public notice of the property transfer and protects the new owner's interest.

- Quitclaim Deeds are only for individuals. Businesses and organizations can also use Quitclaim Deeds to transfer property interests.

By addressing these misconceptions, individuals can make informed decisions regarding property transactions in West Virginia.

Similar forms

A Warranty Deed is similar to a Quitclaim Deed in that both are used to transfer property ownership. However, the key difference lies in the level of protection provided to the buyer. A Warranty Deed guarantees that the seller holds clear title to the property and has the right to sell it. In contrast, a Quitclaim Deed offers no such assurances. It simply transfers whatever interest the seller has in the property, if any. This makes Warranty Deeds generally more secure for buyers, especially when purchasing property.

A Bargain and Sale Deed also resembles a Quitclaim Deed, but it includes some implied warranties. While it does not provide the same level of protection as a Warranty Deed, it suggests that the seller has the right to sell the property. The seller is not guaranteeing that there are no liens or claims against the property, but they are asserting that they hold some interest in it. This type of deed is often used in transactions where the seller may not want to provide full warranties but still wants to indicate ownership.

Understanding the various types of deeds is crucial for anyone looking to navigate the complexities of property ownership and transfers. Each deed type serves a different purpose, and knowing these distinctions can help buyers make informed decisions. For further guidance on related legal documents, resources like TopTemplates.info can offer valuable insights into important forms such as Recommendation Letters, which can aid in documenting personal and professional qualifications.

A Special Purpose Deed, such as a Deed in Lieu of Foreclosure, shares similarities with a Quitclaim Deed in that it is used to transfer property ownership under specific circumstances. In this case, the property owner voluntarily gives the property back to the lender to avoid foreclosure. Like a Quitclaim Deed, this transfer does not guarantee that the property is free of liens or other claims. Instead, it serves to simplify the process of relinquishing ownership when facing financial difficulties.

An Executor's Deed is another document that can be compared to a Quitclaim Deed. This type of deed is used when a property owner passes away, and the executor of the estate transfers the property to heirs or beneficiaries. While an Executor's Deed may not provide the same protections as a Warranty Deed, it does signify that the executor has the authority to transfer the property on behalf of the deceased. Like a Quitclaim Deed, it may not guarantee a clear title, but it serves to facilitate the transfer of property ownership in the context of estate management.

A Trustee's Deed is similar in that it involves the transfer of property by a trustee, who manages the property on behalf of another party. This deed is often used in situations involving trusts. While a Quitclaim Deed simply conveys whatever interest the seller has, a Trustee's Deed may provide some assurances about the trustee's authority to act. However, it typically does not guarantee a clear title, much like a Quitclaim Deed, making it essential for the buyer to conduct due diligence.

Finally, a Mineral Deed is akin to a Quitclaim Deed in that it transfers specific rights related to mineral interests in a property. This type of deed is often used when the seller wishes to convey their rights to minerals, such as oil or gas, without transferring the entire property. Similar to a Quitclaim Deed, a Mineral Deed does not provide warranties regarding the ownership of the mineral rights, meaning the buyer must be cautious and aware of potential claims against those rights.

Key Facts about West Virginia Quitclaim Deed

What is a Quitclaim Deed in West Virginia?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without making any guarantees about the property title. It allows the grantor (the person transferring the property) to convey their interest in the property to the grantee (the person receiving the property). This type of deed is often used among family members or in situations where the parties know each other well, as it does not provide the same level of protection as a warranty deed.

When should I use a Quitclaim Deed?

You might consider using a Quitclaim Deed in several situations. Common scenarios include transferring property between family members, adding or removing a spouse from the title after marriage or divorce, or clarifying ownership in cases of joint ownership. It is important to note that a Quitclaim Deed does not clear any liens or claims against the property, so it is advisable to ensure that the title is clear before proceeding.

How do I complete a Quitclaim Deed in West Virginia?

To complete a Quitclaim Deed, you will need to gather specific information about the property and the parties involved. This includes the legal description of the property, the names of the grantor and grantee, and their addresses. After filling out the form, both parties must sign it in the presence of a notary public. Once notarized, the deed should be filed with the local county clerk’s office to make the transfer official.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed transfers whatever interest the grantor may have in the property without any warranties or guarantees. This makes Quitclaim Deeds less secure for the grantee.

Are there any tax implications when using a Quitclaim Deed?

In West Virginia, transferring property through a Quitclaim Deed may have tax implications, particularly concerning property taxes and potential capital gains taxes. Generally, the transfer itself does not incur a tax, but if the property is sold later, the grantee may be responsible for taxes on any profit made. It is wise to consult with a tax professional to understand the specific implications for your situation.

Can I revoke a Quitclaim Deed after it has been executed?

Once a Quitclaim Deed has been executed and recorded, it is generally considered final and cannot be revoked unilaterally. However, if both parties agree, they can execute a new deed to reverse the transaction. Additionally, in some cases, it may be possible to challenge the deed in court if there was fraud or undue influence involved in the signing process.

Where can I find a Quitclaim Deed form for West Virginia?

You can find a Quitclaim Deed form for West Virginia online through various legal document websites or at your local county clerk’s office. Many legal service providers offer templates that comply with state requirements. Ensure that any form you use is up-to-date and meets the specific needs of your transaction.

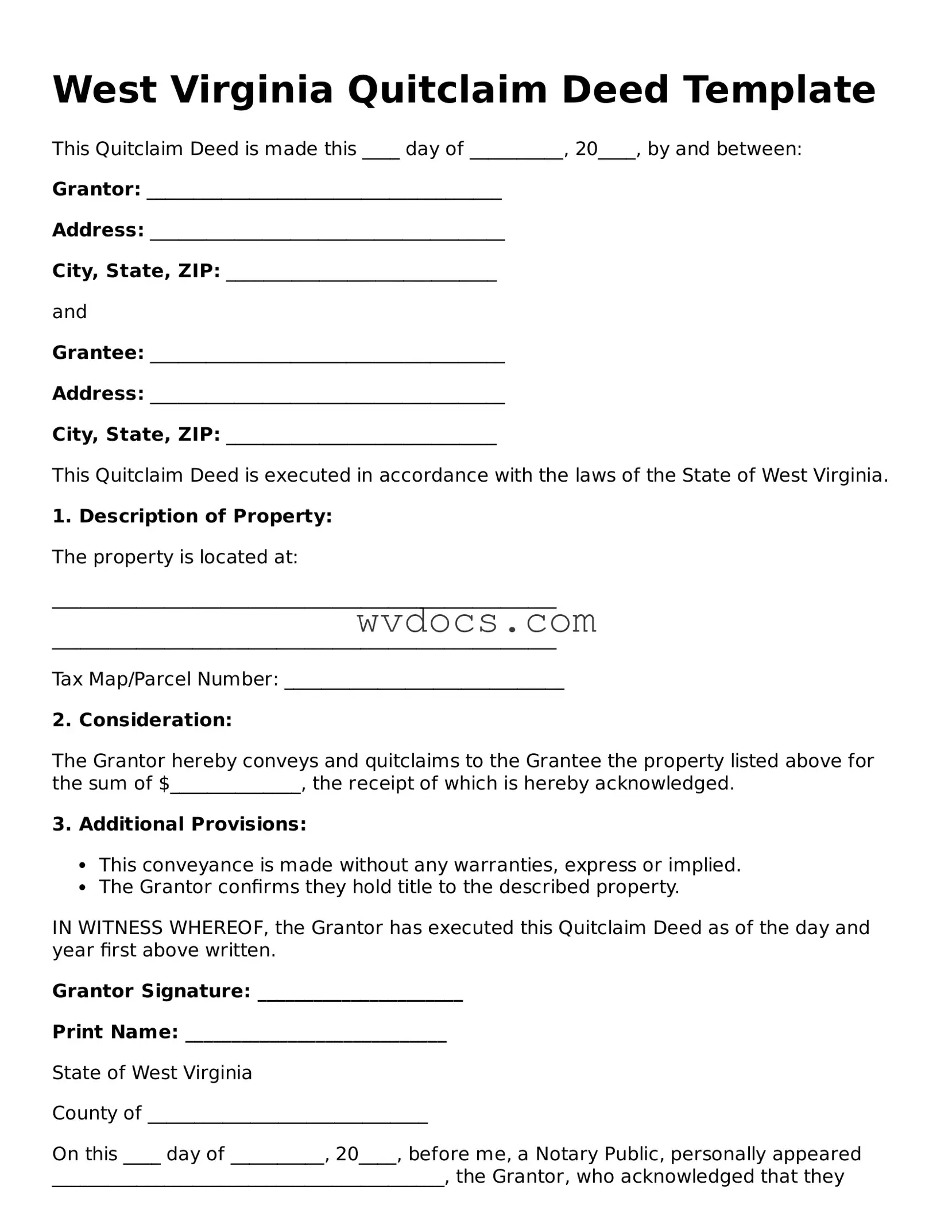

Preview - West Virginia Quitclaim Deed Form

West Virginia Quitclaim Deed Template

This Quitclaim Deed is made this ____ day of __________, 20____, by and between:

Grantor: ______________________________________

Address: ______________________________________

City, State, ZIP: _____________________________

and

Grantee: ______________________________________

Address: ______________________________________

City, State, ZIP: _____________________________

This Quitclaim Deed is executed in accordance with the laws of the State of West Virginia.

1. Description of Property:

The property is located at:

______________________________________________________

______________________________________________________

Tax Map/Parcel Number: ______________________________

2. Consideration:

The Grantor hereby conveys and quitclaims to the Grantee the property listed above for the sum of $______________, the receipt of which is hereby acknowledged.

3. Additional Provisions:

- This conveyance is made without any warranties, express or implied.

- The Grantor confirms they hold title to the described property.

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed as of the day and year first above written.

Grantor Signature: ______________________

Print Name: ____________________________

State of West Virginia

County of ______________________________

On this ____ day of __________, 20____, before me, a Notary Public, personally appeared __________________________________________, the Grantor, who acknowledged that they executed the same for the purposes therein contained.

Notary Public Signature: ______________________

My Commission Expires: ______________________

Documents used along the form

When dealing with property transfers in West Virginia, the Quitclaim Deed is a common document. However, several other forms and documents often accompany it to ensure a smooth transaction. Here’s a list of those documents, each serving a unique purpose in the process.

- Warranty Deed: This document provides a guarantee that the seller has clear title to the property. It assures the buyer that there are no hidden claims against the property.

- Power of Attorney: If the seller cannot be present during the transaction, a power of attorney allows someone else to sign documents on their behalf. For more details, you can refer to the POA.

- Title Search Report: A title search report reveals any liens, encumbrances, or claims against the property. This helps buyers understand the property's legal standing before purchase.

- Property Transfer Tax Form: This form is required for tax purposes when transferring property. It outlines the details of the transaction and the applicable taxes.

- Affidavit of Title: This sworn statement confirms that the seller is the rightful owner of the property and that there are no undisclosed issues affecting the title.

- Property Disclosure Statement: This document provides information about the property's condition. Sellers disclose known issues that could affect the buyer's decision.

- Closing Statement: Also known as a HUD-1, this document summarizes the financial aspects of the transaction, including costs and fees for both the buyer and seller.

- Power of Attorney: If the seller cannot be present during the transaction, a power of attorney allows someone else to sign documents on their behalf.

- Notarized Affidavit: This document may be required to verify the identity of the parties involved in the transaction. It is often notarized to ensure authenticity.

These documents play vital roles in the property transfer process. Having them prepared and organized can make the transaction smoother and help avoid potential disputes later on.