Valid West Virginia Rental Application Document

Key takeaways

When filling out and using the West Virginia Rental Application form, it is essential to understand several key points to ensure a smooth process for both tenants and landlords.

- Personal Information: Provide accurate personal details, including your full name, contact information, and Social Security number. This information is crucial for background checks.

- Rental History: Include a comprehensive rental history. List previous addresses, landlord names, and contact information to help verify your rental background.

- Employment Details: Disclose your current employment status. Include your employer's name, address, and your position to demonstrate financial stability.

- Income Verification: Be prepared to provide proof of income. This may include pay stubs, tax returns, or bank statements to confirm your ability to pay rent.

- References: List personal and professional references. These individuals can vouch for your character and reliability as a tenant.

- Application Fee: Be aware that landlords may charge a non-refundable application fee. This fee typically covers the cost of background checks and processing the application.

- Background Checks: Understand that landlords often conduct background checks. This may include credit history, criminal history, and eviction records.

- Timeliness: Submit the application promptly. Delays in submission may result in losing the rental opportunity to other applicants.

- Review Before Signing: Carefully review the entire application before signing. Ensure that all information is accurate and complete to avoid issues later.

By following these guidelines, applicants can enhance their chances of securing a rental property while landlords can make informed decisions based on the information provided.

Other Common West Virginia Templates

Create an Operating Agreement - An Operating Agreement is critical in guiding business operations.

West Virginia Non-compete Contract - Non-compete agreements can play a crucial role in shaping industry dynamics and competition.

For those looking to establish a solid foundation for their business, the Florida Operating Agreement form is an indispensable tool that outlines essential governance procedures. Access more information about the form in this useful guide on how to create a proper Operating Agreement for your LLC: how to create a proper Operating Agreement.

How to Get Power of Attorney in Wv - Allows for the management of your child’s activities and commitments.

Misconceptions

Understanding the West Virginia Rental Application form is essential for both landlords and tenants. However, there are several misconceptions that can lead to confusion. Here are seven common misconceptions:

- All rental applications are the same. Many people believe that rental applications across the country follow the same format. In reality, each state, including West Virginia, has its own specific requirements and forms.

- Only landlords need to fill out the application. Some tenants think that the application is solely for the landlord's benefit. However, it serves as a tool for both parties to ensure a good fit and clear understanding of expectations.

- A rental application guarantees approval. Many assume that completing the application means they will automatically secure the rental. This is not true; landlords have the right to deny applications based on various factors.

- Personal information is not necessary. Some applicants feel uncomfortable providing personal details. However, landlords require this information to assess financial stability and rental history.

- There are no fees associated with the application. Many tenants think that applying for a rental is free. In West Virginia, landlords may charge an application fee to cover background checks and processing.

- Once submitted, the application cannot be changed. Some individuals believe that their application is set in stone. In fact, applicants can update or correct information before a decision is made.

- Landlords must provide a reason for denial. While it is good practice for landlords to communicate reasons for denial, they are not legally required to do so in West Virginia.

By addressing these misconceptions, both landlords and tenants can navigate the rental process with greater clarity and confidence.

Similar forms

The West Virginia Rental Application form shares similarities with the standard Lease Agreement. Both documents serve as essential tools in the rental process. The Lease Agreement outlines the terms and conditions of the rental arrangement, including rent amount, duration, and responsibilities of both parties. Just like the Rental Application, it requires personal information from the tenant, ensuring that landlords have a clear understanding of who they are renting to. This connection emphasizes the importance of transparency and mutual understanding in rental agreements.

Another document akin to the West Virginia Rental Application is the Tenant Screening Report. This report provides landlords with critical insights into a potential tenant's background, including credit history and rental history. Much like the Rental Application, it helps landlords assess the suitability of a tenant. Both documents aim to protect the interests of landlords by ensuring that they select responsible tenants who are likely to fulfill their lease obligations.

The Employment Verification form is also similar to the Rental Application. This document confirms a tenant's employment status and income level, which are vital for landlords when determining whether a tenant can afford the rent. The Rental Application typically requires applicants to disclose their employment information, creating a direct link between the two. Both documents work together to provide a comprehensive view of a tenant's financial stability.

Additionally, the Personal Reference Form bears resemblance to the Rental Application. This form gathers information about individuals who can vouch for the tenant's character and reliability. Just as the Rental Application collects personal details, the Personal Reference Form seeks to add another layer of assurance for landlords. Both documents help build a profile of the tenant, aiding landlords in making informed decisions.

For those looking to complete a transaction in California, it is essential to utilize the California Bill of Sale form. This document serves not only as proof of the sale but also details the specifics of the item being sold, including the sale price and the parties involved. To avoid any ambiguities, individuals can refer to a comprehensive resource available at https://toptemplates.info/bill-of-sale/california-bill-of-sale that provides guidance on properly completing this crucial legal form.

The Credit Application is another document that parallels the West Virginia Rental Application. This form focuses specifically on a tenant's creditworthiness, often requiring the same personal information found in a rental application. Both documents are tools for landlords to evaluate the financial responsibility of potential tenants. They serve as safeguards, helping landlords avoid tenants who may struggle to meet their financial obligations.

The Move-In Checklist is also similar in its purpose of ensuring clarity and accountability. While it is typically completed after a tenant has been approved, it shares the goal of documenting the condition of the rental property. Like the Rental Application, it requires attention to detail and careful consideration. Both documents contribute to a smooth rental experience by setting clear expectations for both parties.

The Rental History Verification form connects closely with the West Virginia Rental Application as well. This document allows landlords to confirm a potential tenant's previous rental experiences. By seeking references from past landlords, it complements the information provided in the Rental Application. Both documents aim to assess a tenant's reliability and history in fulfilling rental agreements.

Another related document is the Guarantor Agreement. This form is often required when a tenant does not meet certain financial criteria. It provides a backup by having a third party agree to take on financial responsibility if the tenant fails to pay rent. The Guarantor Agreement is linked to the Rental Application as it often comes into play when the information provided in the application raises concerns about the tenant's ability to pay.

The Security Deposit Receipt is also similar in its purpose of protecting both the landlord and tenant. While it is issued after the rental agreement is signed, it is directly tied to the terms outlined in the Rental Application. Both documents deal with the financial aspects of renting and ensure that both parties are aware of their rights and responsibilities regarding the security deposit.

Lastly, the Pet Application is another document that aligns with the West Virginia Rental Application. If a tenant wishes to have a pet in a rental property, this form is often required to assess the suitability of the pet. Similar to the Rental Application, it gathers personal information and may require references. Both documents serve to inform the landlord about the tenant's lifestyle and preferences, helping to create a harmonious living environment.

Key Facts about West Virginia Rental Application

What is the purpose of the West Virginia Rental Application form?

The West Virginia Rental Application form is designed to help landlords screen potential tenants. It collects essential information about the applicant, including their rental history, employment details, and financial status. This process aids landlords in making informed decisions about who to rent their properties to, ensuring a good fit for both parties.

What information is typically required on the application?

Applicants will generally need to provide personal information such as their name, contact details, and Social Security number. Additionally, the form may ask for current and previous addresses, employment history, income details, and references. Some landlords might also request consent for a background or credit check.

Is there a fee associated with the rental application?

Many landlords charge a non-refundable application fee to cover the costs of processing the application, including background checks. The amount can vary widely, so it’s essential to inquire about any fees before submitting the application.

How long does it take to process a rental application?

The processing time for a rental application can vary based on the landlord or property management company. Typically, it may take anywhere from a few hours to several days. Applicants should ask about the expected timeline when they submit their application to manage their expectations.

Can an application be denied? If so, why?

Yes, a rental application can be denied for various reasons. Common factors include poor credit history, insufficient income, a negative rental history, or failing to provide accurate information. Landlords are usually required to inform applicants of the reasons for denial, especially if it is based on a credit report.

What rights do applicants have regarding their rental application?

Applicants have the right to fair treatment throughout the application process. This includes the right to know if their application is denied and the reasons behind that decision. Additionally, applicants can request a copy of their credit report if it was used in the decision-making process, as per the Fair Credit Reporting Act.

How can applicants improve their chances of approval?

To enhance the likelihood of approval, applicants should provide complete and accurate information on their rental application. Including references, proof of income, and a positive rental history can strengthen their case. Additionally, being prepared to pay the application fee promptly and demonstrating good communication can make a favorable impression on landlords.

What should applicants do if they have a poor rental history?

If an applicant has a poor rental history, it’s advisable to be upfront about it. Providing explanations for past issues, such as job loss or personal circumstances, can help landlords understand the context. Offering additional references or a co-signer may also improve the chances of approval.

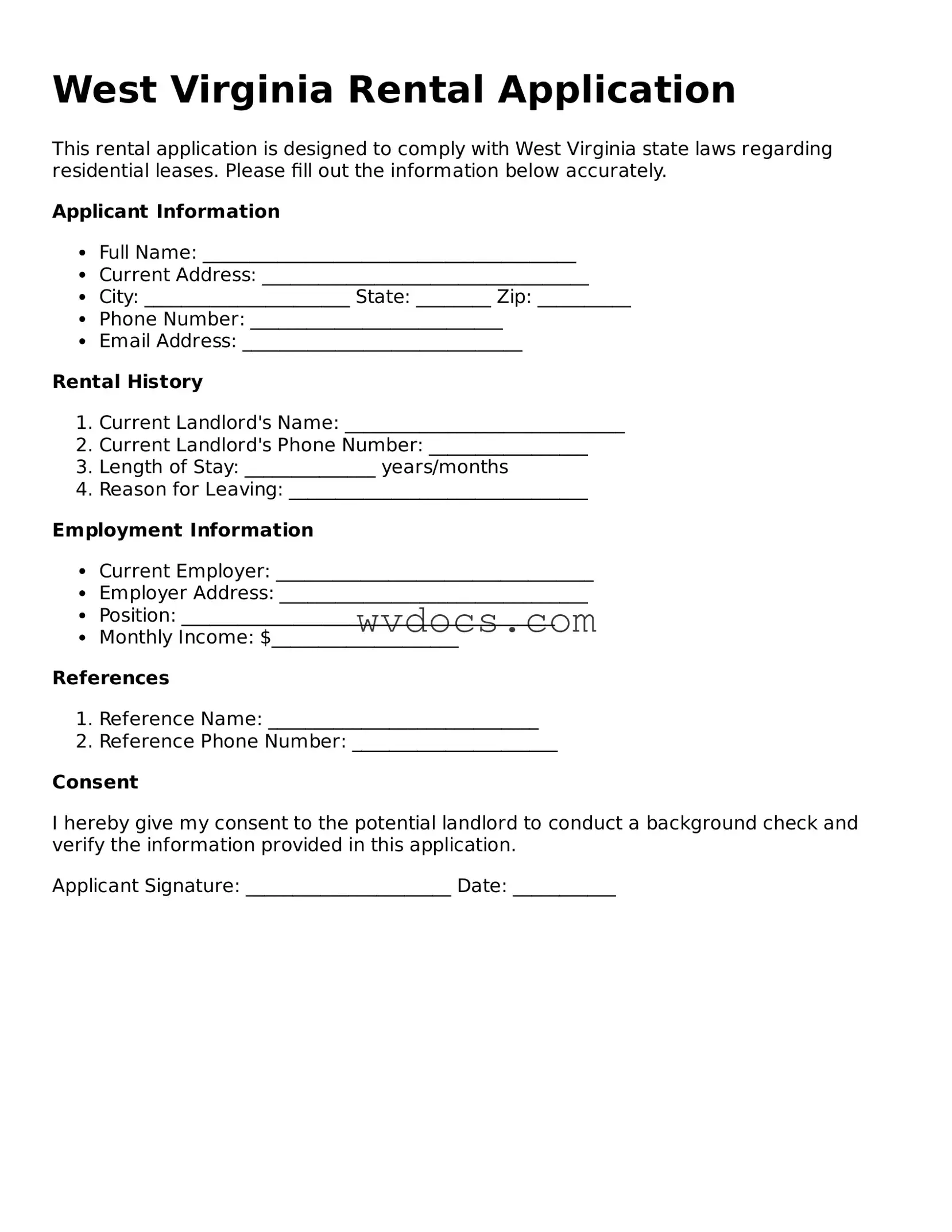

Preview - West Virginia Rental Application Form

West Virginia Rental Application

This rental application is designed to comply with West Virginia state laws regarding residential leases. Please fill out the information below accurately.

Applicant Information

- Full Name: ________________________________________

- Current Address: ___________________________________

- City: ______________________ State: ________ Zip: __________

- Phone Number: ___________________________

- Email Address: ______________________________

Rental History

- Current Landlord's Name: ______________________________

- Current Landlord's Phone Number: _________________

- Length of Stay: ______________ years/months

- Reason for Leaving: ________________________________

Employment Information

- Current Employer: __________________________________

- Employer Address: _________________________________

- Position: ________________________________________

- Monthly Income: $____________________

References

- Reference Name: _____________________________

- Reference Phone Number: ______________________

Consent

I hereby give my consent to the potential landlord to conduct a background check and verify the information provided in this application.

Applicant Signature: ______________________ Date: ___________

Documents used along the form

When applying for a rental property in West Virginia, several additional forms and documents may be required to support the application process. These documents help landlords evaluate potential tenants and ensure a smooth leasing experience. Below is a list of common forms that are often used alongside the West Virginia Rental Application form.

- Credit Report Authorization: This form allows landlords to obtain a credit report on the applicant. It provides insights into the applicant's credit history and financial responsibility.

- Background Check Consent: This document grants permission for landlords to conduct a background check. It typically includes criminal history and eviction records.

- Proof of Income: Applicants may need to provide recent pay stubs, tax returns, or bank statements to verify their income and ability to pay rent.

- Rental History Verification: This form is used to confirm the applicant's previous rental history. Landlords may contact former landlords to assess payment history and behavior.

- Articles of Incorporation: This essential form establishes a corporation in New York, detailing its name, purpose, and incorporators. For more information on how to fill it out, visit smarttemplates.net.

- Employment Verification: Landlords may request a form to verify the applicant's employment status and income. This helps ensure the applicant has a stable job.

- Pet Agreement: If the rental property allows pets, this document outlines the terms and conditions related to pet ownership, including any additional fees or deposits.

- Lease Agreement: Once the application is approved, a lease agreement is drafted. This legally binding document outlines the terms of the rental, including duration, rent amount, and responsibilities of both parties.

Having these documents ready can expedite the application process and improve your chances of securing the rental property you desire. Be proactive and ensure all necessary paperwork is complete before submitting your application.