Valid West Virginia Small Estate Affidavit Document

Key takeaways

Filling out the West Virginia Small Estate Affidavit form can simplify the process of settling a small estate. Here are some key takeaways to keep in mind:

- The Small Estate Affidavit is intended for estates with a total value of $50,000 or less, excluding certain assets.

- Affidavits must be signed by all heirs or beneficiaries, ensuring everyone is in agreement.

- It is important to include all required information, such as the decedent's details and a list of assets.

- Once completed, the affidavit must be filed with the local circuit court to initiate the process of transferring assets.

Other Common West Virginia Templates

Notice of Intent to Homeschool Wv - It shows intention to provide an alternative education to traditional schooling.

For businesses looking to establish a solid foundation, understanding the importance of an effective Operating Agreement is vital. This document is not just a formality; it plays a key role in defining the internal dynamics and responsibilities of members within an LLC.

How to Get Power of Attorney in Wv - Grants authority to act on behalf of your child in specified matters.

Wv Living Will - A Living Will allows individuals to express their healthcare preferences in advance.

Misconceptions

Many people have misunderstandings about the West Virginia Small Estate Affidavit form. Clearing up these misconceptions can help individuals navigate the estate settlement process more smoothly. Here are six common misconceptions:

- Only wealthy individuals can use the Small Estate Affidavit. This is not true. The Small Estate Affidavit is designed for estates with a total value under a certain threshold, making it accessible for many individuals, regardless of their wealth.

- The Small Estate Affidavit can only be used for estates without a will. This is a misconception. Even if there is a will, if the estate falls under the value limit, the Small Estate Affidavit can still be utilized to expedite the process.

- All debts must be paid before using the Small Estate Affidavit. While it is important to address debts, the Small Estate Affidavit allows for a simplified process. Creditors can still be paid after the affidavit is filed, as long as the estate has sufficient assets.

- Filing a Small Estate Affidavit is the same as probate. This is misleading. The Small Estate Affidavit is a simplified procedure that can bypass the full probate process, which can be lengthy and complex.

- Anyone can file a Small Estate Affidavit. Only certain individuals, typically the heirs or beneficiaries, are eligible to file. This ensures that the right people are managing the estate.

- The Small Estate Affidavit is a permanent solution for all estate matters. This is incorrect. The affidavit is a tool for settling specific estates, but it does not address ongoing estate management or future legal issues that may arise.

Understanding these misconceptions can empower individuals to make informed decisions about estate matters in West Virginia. Always consider seeking legal advice for personalized guidance.

Similar forms

The West Virginia Small Estate Affidavit form shares similarities with the Affidavit of Heirship. Both documents are used to establish the rightful heirs to a deceased person's estate. In the case of the Affidavit of Heirship, it serves to confirm the identity of heirs when a person dies without a will. This affidavit is often used to transfer property or assets when the estate's value is below a certain threshold, similar to the Small Estate Affidavit, which simplifies the probate process for smaller estates.

When it comes to transferring ownership of vehicles like ATVs, a specific legal document is required to facilitate the process. For California residents, the California ATV Bill of Sale form is essential, as it records the sale and ensures compliance with state laws. Just as various legal documents simplify asset transfer in different situations, this form provides clarity in ATV transactions. For more details on how to properly complete this form, you can visit onlinelawdocs.com/california-atv-bill-of-sale.

Another document similar to the Small Estate Affidavit is the Will. While a Will outlines how a person wishes to distribute their assets after death, the Small Estate Affidavit is used when there is no Will. Both documents aim to facilitate the transfer of assets, but the Small Estate Affidavit is particularly useful for those who want to avoid the lengthy probate process associated with larger estates. In essence, both serve the purpose of ensuring that a deceased person's wishes regarding their estate are honored.

The Affidavit for Collection of Personal Property is also comparable to the Small Estate Affidavit. This document allows an individual to claim personal property of a deceased person without going through formal probate. Like the Small Estate Affidavit, it is designed for situations where the estate is small and the process can be expedited. Both documents simplify the transfer of assets, making it easier for heirs to access what they are entitled to without unnecessary delays.

Finally, the Petition for Summary Administration is another document that bears similarities to the Small Estate Affidavit. This petition is filed in court to request a simplified probate process for small estates. While the Small Estate Affidavit is a sworn statement made by heirs, the Petition for Summary Administration involves a court's approval. Both documents aim to reduce the complexity and time involved in settling an estate, making it easier for families to manage their loved one's affairs after death.

Key Facts about West Virginia Small Estate Affidavit

What is a Small Estate Affidavit in West Virginia?

A Small Estate Affidavit is a legal document that allows a person to claim the assets of a deceased individual without going through the formal probate process. In West Virginia, this option is available when the total value of the estate is below a certain threshold. This can simplify the process of transferring assets to the rightful heirs or beneficiaries.

Who can use a Small Estate Affidavit?

Generally, any person who is entitled to inherit from the deceased can use a Small Estate Affidavit. This includes heirs, beneficiaries named in a will, or individuals who can demonstrate their right to the estate according to state law. It's important to note that all heirs must agree to use this method for it to be valid.

What assets can be claimed using a Small Estate Affidavit?

Typically, a Small Estate Affidavit can be used to claim personal property, bank accounts, and certain other assets owned by the deceased. However, real estate is generally excluded from this process. Always check the specific laws in West Virginia to ensure that the assets in question qualify.

What is the process for completing a Small Estate Affidavit?

The process involves filling out the Small Estate Affidavit form, which requires information about the deceased, their assets, and the heirs. Once the form is completed, it must be signed in front of a notary. After notarization, the affidavit can be presented to financial institutions or other entities holding the deceased's assets to facilitate the transfer.

Is there a deadline for filing a Small Estate Affidavit?

There is no specific deadline for filing a Small Estate Affidavit in West Virginia. However, it is advisable to complete the process in a timely manner to avoid complications. Delays may lead to issues with accessing the deceased's assets or complications with the heirs’ rights.

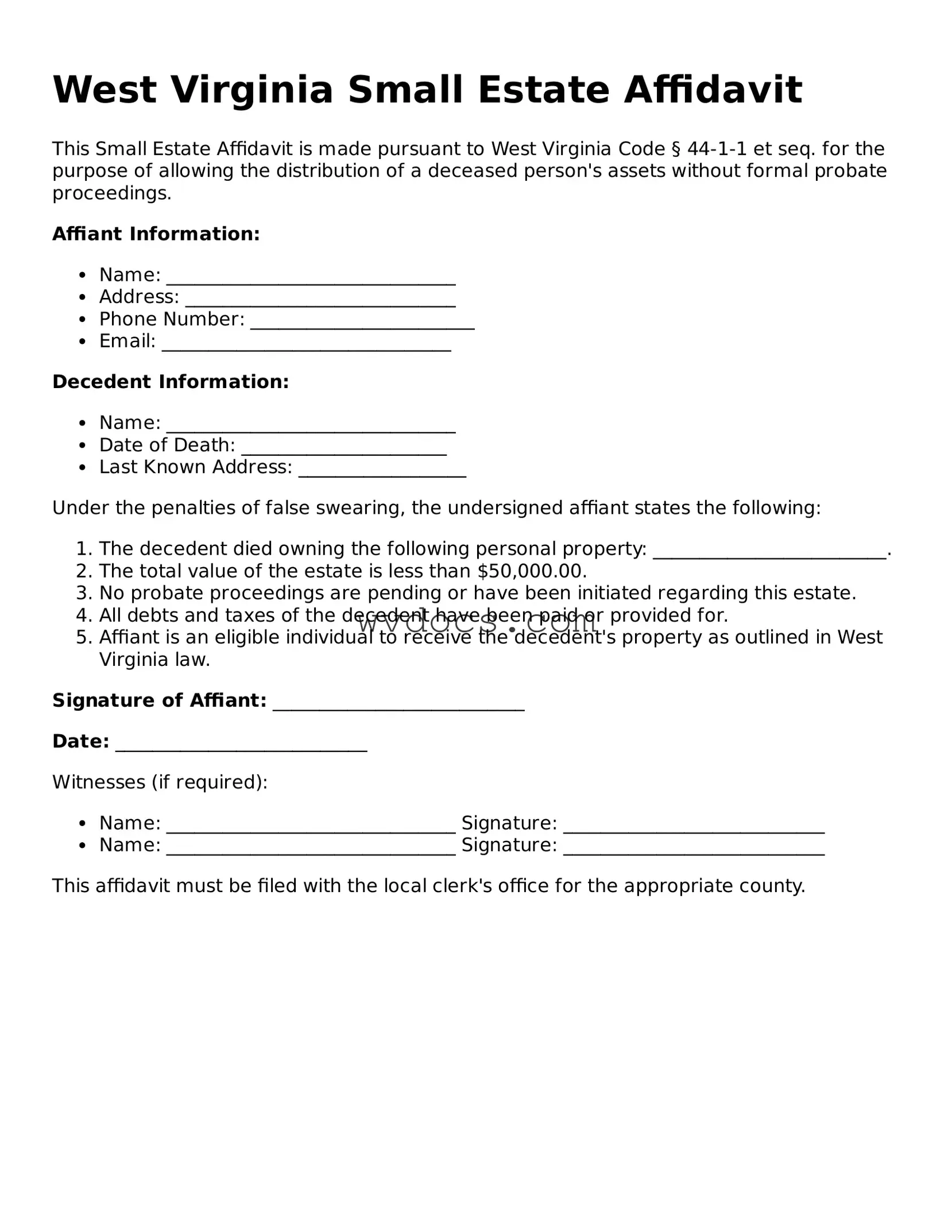

Preview - West Virginia Small Estate Affidavit Form

West Virginia Small Estate Affidavit

This Small Estate Affidavit is made pursuant to West Virginia Code § 44-1-1 et seq. for the purpose of allowing the distribution of a deceased person's assets without formal probate proceedings.

Affiant Information:

- Name: _______________________________

- Address: _____________________________

- Phone Number: ________________________

- Email: _______________________________

Decedent Information:

- Name: _______________________________

- Date of Death: ______________________

- Last Known Address: __________________

Under the penalties of false swearing, the undersigned affiant states the following:

- The decedent died owning the following personal property: _________________________.

- The total value of the estate is less than $50,000.00.

- No probate proceedings are pending or have been initiated regarding this estate.

- All debts and taxes of the decedent have been paid or provided for.

- Affiant is an eligible individual to receive the decedent's property as outlined in West Virginia law.

Signature of Affiant: ___________________________

Date: ___________________________

Witnesses (if required):

- Name: _______________________________ Signature: ____________________________

- Name: _______________________________ Signature: ____________________________

This affidavit must be filed with the local clerk's office for the appropriate county.

Documents used along the form

When navigating the process of settling a small estate in West Virginia, several forms and documents may be required in addition to the Small Estate Affidavit. Each document serves a specific purpose, aiding in the efficient transfer of assets and ensuring compliance with state laws. Below is a list of commonly used forms and documents that may accompany the Small Estate Affidavit.

- Death Certificate: This official document verifies the passing of the deceased and is often required to initiate the estate settlement process.

- Will: If the deceased left a will, it may be necessary to present it to validate the decedent's wishes regarding asset distribution.

- List of Assets: A detailed inventory of the deceased's assets can help clarify what is included in the small estate and simplify the transfer process.

- Affidavit of Heirship: This document establishes the rightful heirs of the deceased, especially useful when there is no will or when the will is contested.

- Real Estate Purchase Agreement: For any transactions involving real estate, it’s crucial to have a legally binding agreement in place, such as the TopTemplates.info to ensure both parties understand their obligations and rights.

- Bank Statements: Recent bank statements may be needed to identify the deceased’s financial accounts and ascertain their value at the time of death.

- Property Deeds: If real estate is part of the estate, providing copies of property deeds will assist in transferring ownership to the heirs.

- Tax Returns: The deceased's last tax returns may be necessary to ensure that any outstanding taxes are addressed during the estate settlement.

- Creditor Claims: Documentation of any outstanding debts or claims against the estate should be gathered to settle all financial obligations before distribution.

- Notice to Creditors: This form notifies potential creditors of the estate's opening, allowing them to file claims against the estate within a specified period.

Having these documents prepared and organized can significantly streamline the estate settlement process. Each form plays a vital role in ensuring that the wishes of the deceased are honored and that the legal requirements are met. Taking the time to gather the necessary paperwork can alleviate some of the burdens during what is often a challenging time.