Valid West Virginia Transfer-on-Death Deed Document

Key takeaways

When filling out and using the West Virginia Transfer-on-Death Deed form, consider the following key takeaways:

- Eligibility: Only individuals who own real property in West Virginia can use this deed. Ensure that the property is eligible for transfer upon death.

- Completing the Form: Fill out the form accurately, including the names of the beneficiaries and a legal description of the property. Mistakes can lead to complications.

- Signatures Required: The deed must be signed by the property owner in the presence of a notary public. This step is crucial for the deed to be valid.

- Recording the Deed: After completion, the deed should be recorded with the county clerk’s office where the property is located. This action ensures that the transfer is legally recognized.

Other Common West Virginia Templates

Gun Laws in Wv - Promotes clear communication between buying and selling parties.

In addition to the importance of the California ATV Bill of Sale form, it's essential for both sellers and buyers to be informed about the various resources available for completing this transaction. For more detailed information and guidance on drafting this vital document, you can visit https://onlinelawdocs.com/, which provides valuable insights into the legal requirements and templates related to the sale of ATVs in California.

Power of Attorney West Virginia - This document grants authority to handle financial and legal affairs.

Wv Living Will - A Living Will is an important element of a patient-centered approach to healthcare.

Misconceptions

Understanding the West Virginia Transfer-on-Death Deed form is crucial for anyone considering estate planning. However, several misconceptions exist that can lead to confusion. Here are six common misunderstandings:

- It only applies to real estate. Many believe the Transfer-on-Death Deed can only be used for real property. In fact, it specifically allows for the transfer of real estate but does not extend to personal property like cars or bank accounts.

- It requires probate. Some people think that property transferred through this deed must go through probate. However, one of the primary benefits is that it bypasses the probate process entirely, allowing for a smoother transfer upon the owner's death.

- It cannot be revoked. There is a belief that once a Transfer-on-Death Deed is executed, it cannot be changed. This is not true. The owner can revoke or change the deed at any time before their death.

- It only benefits spouses. Many assume that only spouses can be named as beneficiaries. In reality, the deed can name anyone as a beneficiary, including children, friends, or charities.

- It is automatically valid upon signing. Some think that simply signing the deed makes it valid. The deed must be properly recorded with the county clerk’s office to be effective.

- It avoids all taxes. There is a misconception that using a Transfer-on-Death Deed eliminates any tax liabilities. While it may avoid probate taxes, other taxes, such as capital gains taxes, may still apply.

Clearing up these misconceptions can help individuals make informed decisions regarding their estate planning. Understanding the nuances of the Transfer-on-Death Deed is essential for effective management of one’s assets.

Similar forms

The West Virginia Transfer-on-Death Deed (TOD) form shares similarities with a Living Trust. Both documents allow for the transfer of assets without going through probate. A Living Trust is established during the grantor's lifetime and can be modified, while the TOD deed takes effect upon the death of the grantor, making it a simpler option for direct asset transfer to beneficiaries.

Another document similar to the TOD deed is the Last Will and Testament. Both serve to distribute a person's assets after death. However, a will requires probate, which can be a lengthy process, whereas the TOD deed allows for immediate transfer of property without court involvement, streamlining the process for heirs.

The Beneficiary Designation form is also comparable to the TOD deed. This document is commonly used for financial accounts and insurance policies to designate a beneficiary. Like the TOD deed, it allows assets to bypass probate, ensuring that the designated beneficiary receives the asset directly upon the account holder's death.

For those looking to document the sale of personal property in California, utilizing a toptemplates.info/bill-of-sale/california-bill-of-sale can ensure that all necessary details are captured, thereby providing legal protection and clarity for both the buyer and the seller throughout the transaction process.

A Joint Tenancy Agreement is another document that shares similarities with the TOD deed. In a joint tenancy, two or more individuals hold title to a property together, with the right of survivorship. When one owner passes away, their share automatically transfers to the surviving owner, similar to how a TOD deed facilitates the transfer of property upon death.

The Transfer-on-Death Registration for vehicles functions similarly to the TOD deed, allowing vehicle owners to designate a beneficiary. Upon the owner's death, the vehicle transfers directly to the named beneficiary without going through probate, simplifying the transfer process for personal property.

A Life Estate Deed is another related document. This deed allows a person to retain the right to use and occupy a property during their lifetime, with the property passing to a designated beneficiary upon their death. Like the TOD deed, it provides a way to transfer property outside of probate, ensuring a smoother transition for heirs.

The Durable Power of Attorney (DPOA) can also be likened to the TOD deed in terms of asset management. While the DPOA grants someone authority to manage another's affairs while they are alive, it does not transfer ownership upon death. However, both documents serve to ensure that a person's wishes are respected and followed regarding their assets.

The Revocable Living Trust is similar to the TOD deed in that both allow for the management and distribution of assets. A revocable living trust can be altered or revoked during the grantor's lifetime, while the TOD deed is fixed once executed. Both methods avoid probate, making them efficient options for estate planning.

Finally, the Family Limited Partnership (FLP) is comparable to the TOD deed as both can facilitate the transfer of assets to family members. An FLP allows family members to pool resources and manage assets collectively, providing a way to pass on wealth while maintaining control during the grantor's lifetime. Like the TOD deed, it can help avoid probate, making the transfer process smoother for the family.

Key Facts about West Virginia Transfer-on-Death Deed

What is a Transfer-on-Death Deed in West Virginia?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows a property owner to transfer their real estate to a designated beneficiary upon their death. This deed avoids probate, making the transfer process simpler and faster for the beneficiary.

Who can create a Transfer-on-Death Deed?

Any individual who is the owner of real property in West Virginia can create a Transfer-on-Death Deed. This includes sole owners or co-owners of the property. However, it is important that the person creating the deed is of sound mind and legal age.

What information is needed to complete the Transfer-on-Death Deed?

To complete a TOD Deed, you will need the legal description of the property, the names and addresses of the property owner(s), and the name and address of the designated beneficiary. It's essential to ensure that all information is accurate to avoid complications later.

Does the Transfer-on-Death Deed need to be notarized?

Yes, in West Virginia, a Transfer-on-Death Deed must be signed in the presence of a notary public. This ensures that the document is legally valid and can be enforced after the property owner’s death.

Can I revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked at any time before the property owner's death. This can be done by executing a new deed that explicitly states the revocation or by recording a revocation document with the county clerk.

What happens if the beneficiary predeceases the property owner?

If the designated beneficiary dies before the property owner, the Transfer-on-Death Deed becomes void. The property owner can then choose to designate a new beneficiary or allow the property to pass according to their will or state law.

Is a Transfer-on-Death Deed subject to taxes?

Generally, a Transfer-on-Death Deed does not trigger immediate tax consequences. However, the beneficiary may be responsible for property taxes once the transfer is complete. It's advisable to consult a tax professional for specific advice related to your situation.

How do I record a Transfer-on-Death Deed?

To record a Transfer-on-Death Deed, you must take the signed and notarized document to the county clerk's office in the county where the property is located. There may be a recording fee, so be prepared for that when you go to file the deed.

Can I use a Transfer-on-Death Deed for any type of property?

A Transfer-on-Death Deed can be used for most types of real property, including residential homes and vacant land. However, it cannot be used for personal property or assets like bank accounts or vehicles. Always check local laws for any specific restrictions.

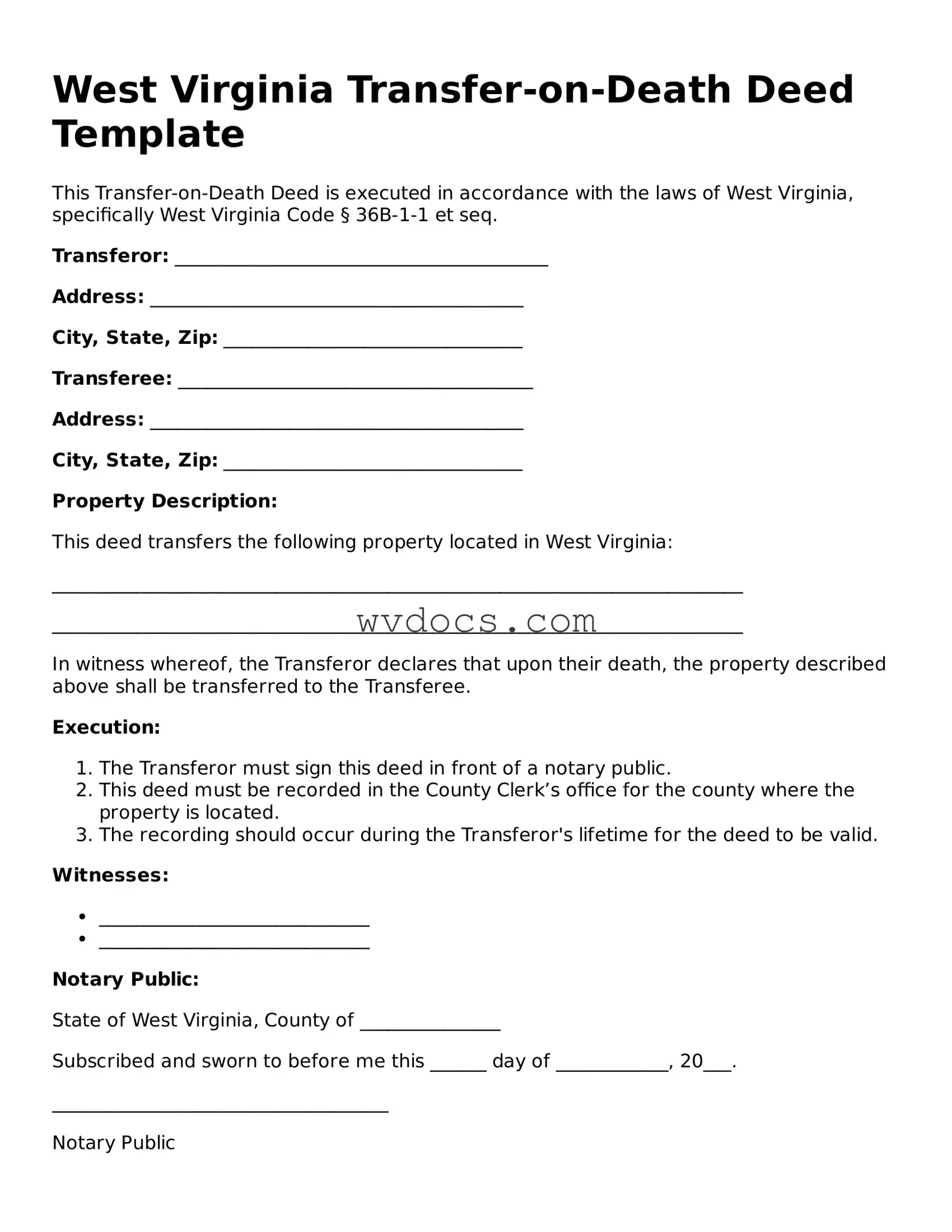

Preview - West Virginia Transfer-on-Death Deed Form

West Virginia Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with the laws of West Virginia, specifically West Virginia Code § 36B-1-1 et seq.

Transferor: ________________________________________

Address: ________________________________________

City, State, Zip: ________________________________

Transferee: ______________________________________

Address: ________________________________________

City, State, Zip: ________________________________

Property Description:

This deed transfers the following property located in West Virginia:

__________________________________________________________________________

__________________________________________________________________________

In witness whereof, the Transferor declares that upon their death, the property described above shall be transferred to the Transferee.

Execution:

- The Transferor must sign this deed in front of a notary public.

- This deed must be recorded in the County Clerk’s office for the county where the property is located.

- The recording should occur during the Transferor's lifetime for the deed to be valid.

Witnesses:

- _____________________________

- _____________________________

Notary Public:

State of West Virginia, County of _______________

Subscribed and sworn to before me this ______ day of ____________, 20___.

____________________________________

Notary Public

My Commission Expires: _______________

Documents used along the form

When considering a Transfer-on-Death (TOD) deed in West Virginia, it's essential to understand that this form often works in conjunction with several other documents. Each of these documents plays a crucial role in ensuring a smooth transfer of property and clarifying the intentions of the property owner. Below is a list of commonly used forms and documents that complement the TOD deed.

- Last Will and Testament: This document outlines how a person's assets should be distributed upon their death. It can provide clarity on the distribution of property not covered by a TOD deed.

- Power of Attorney: This legal document allows someone to act on behalf of another person in legal or financial matters. It can be useful if the property owner becomes incapacitated before passing away.

- Affidavit of Heirship: This sworn statement establishes the heirs of a deceased person, which can be helpful in proving ownership of property when the owner has died without a will.

- Property Deed: The original deed to the property being transferred is necessary for establishing ownership. It details the legal description of the property and the owner's rights.

- Title Insurance Policy: This policy protects against any claims or disputes regarding property ownership. It's often recommended to have this in place when transferring property.

- Notice of Transfer: A document that may be filed with the county clerk to inform interested parties about the transfer of property through a TOD deed.

- Beneficiary Designation Forms: These forms are used to designate beneficiaries for various accounts and assets, ensuring that they are transferred directly to the intended individuals upon death.

- Articles of Incorporation: This essential document establishes a corporation's legal existence in New York, outlining vital information about the entity, including its name and purpose. For more details, visit smarttemplates.net.

- Real Estate Transfer Tax Affidavit: This form may be required to report the transfer of real property and assess any applicable taxes during the transfer process.

- Living Trust Document: A trust can hold property during the owner's lifetime and specify how it should be distributed after death, sometimes working alongside a TOD deed.

- Probate Forms: If the property owner dies without a will, various probate forms may be needed to initiate the legal process of distributing their estate.

Understanding these documents can significantly ease the process of property transfer. Each one serves a specific purpose and can help ensure that your wishes are honored, providing peace of mind for both you and your loved ones.