Official West Virginia Estimated Tax Template in PDF

Key takeaways

- Eligibility: You must make estimated tax payments if you expect to owe at least $600 in state tax when filing your annual return.

- Payment Calculation: Use the instruction brochure (Form IT-140ESI) available on the West Virginia State Tax Department website to determine your estimated tax.

- Minimum Payment Requirement: Pay at least the minimum amount calculated to avoid penalties, but you can pay more if desired.

- Payment Table: Record your payment in the designated payment table on the form to keep track of your submissions.

- Mailing Instructions: Send your completed form and payment to the State Tax Department at the specified address by the due date.

- Change of Address: If any information on the form is incorrect, check the change of address box and provide updated details.

Additional PDF Templates

Business License Wv - Obtaining a Statement of Good Standing can enhance a business's reputation with clients and partners.

Wv State Tax Forms - Correctly calculate your total allowable West Virginia taxable income.

The Arizona Non-disclosure Agreement form is essential for anyone looking to protect their sensitive information from unauthorized disclosure. By ensuring that both parties involved maintain confidentiality, this document is vital for safeguarding trade secrets and proprietary data. For more information and to get started with the process, visit https://arizonapdf.com/, where you can find the necessary resources to fill out the form effectively.

Wv Business Registration - The form ensures compliance with state regulations for foreign corporations.

Misconceptions

- Misconception 1: You only need to file estimated taxes if you are self-employed.

- Misconception 2: Estimated tax payments are optional.

- Misconception 3: You can pay any amount you choose for estimated taxes.

- Misconception 4: The due dates for estimated tax payments are the same for all taxpayers.

- Misconception 5: You can submit your estimated tax payments at any time.

- Misconception 6: You do not need to report changes in your personal information.

- Misconception 7: You cannot file estimated taxes online.

This is incorrect. Any individual who expects to owe at least $600 in state tax must make estimated tax payments, regardless of employment status.

In fact, if you meet the threshold of owing at least $600, making these payments is a requirement to avoid penalties.

While you can pay more than the minimum, you must at least pay the minimum amount calculated using the provided instructions to avoid penalties.

This is not true. If you are not a calendar year taxpayer, you should refer to the specific instructions to determine your payment due dates.

Payments must be mailed by the specified due date to ensure compliance and avoid penalties.

If any preprinted information on the form is incorrect or has changed, you must complete the change of address section to update your records.

Actually, you can file online through the West Virginia State Tax Department's website, making the process more convenient.

Similar forms

The West Virginia Estimated Tax form shares similarities with the Federal Estimated Tax Payment form (IRS Form 1040-ES). Both documents serve the purpose of allowing taxpayers to make estimated tax payments throughout the year. Just as the West Virginia form requires individuals to estimate their tax liability based on expected income, the IRS form also guides taxpayers in calculating their federal tax obligations. Both forms emphasize the importance of timely payments to avoid penalties, and they provide clear instructions on how to submit payments, either through mail or electronically.

Another document comparable to the West Virginia Estimated Tax form is the California Estimated Tax form (Form 540-ES). Like its West Virginia counterpart, the California form is designed for individuals who expect to owe a certain amount of tax when filing their annual returns. Both forms require taxpayers to provide personal information, such as Social Security numbers and addresses. Additionally, both documents include sections for indicating payment amounts and any changes in taxpayer information, ensuring that the relevant tax authorities have accurate and up-to-date records.

The New York State Estimated Tax form (Form IT-2105) is also similar to the West Virginia form. Both documents are utilized by individuals to report and pay estimated taxes based on anticipated income. They require taxpayers to calculate their expected tax liability and provide payment amounts. Both forms contain instructions for determining due dates and emphasize the necessity of making timely payments to avoid penalties. Furthermore, each form allows for adjustments in case of changes in taxpayer circumstances, reinforcing the importance of accurate reporting.

The California ATV Bill of Sale form serves as a vital resource for those looking to engage in the sale and transfer of an all-terrain vehicle (ATV) within the state of California. Just as individuals utilize various forms for tax purposes, this document ensures a transparent and lawful transaction between buyers and sellers. For more guidance, individuals can refer to detailed information available at onlinelawdocs.com/california-atv-bill-of-sale/, which outlines the necessary details to include in the bill of sale, including the ATV's description and transaction specifics.

The Florida Estimated Tax form (Form DR-501) parallels the West Virginia form in that it is used for estimated tax payments. While Florida has no state income tax, the form is still relevant for those who may owe other types of taxes. Both forms guide taxpayers through the process of estimating their tax obligations and making payments. They also provide instructions on how to report changes in personal information, ensuring that taxpayers remain compliant with state regulations.

The Texas Estimated Tax form operates similarly to the West Virginia form, although Texas does not have a state income tax. Taxpayers in Texas may use this form for other estimated taxes, such as franchise taxes. Both documents require personal identification and payment amounts, emphasizing the importance of maintaining accurate records. Each form also provides clear instructions on submitting payments and addressing any changes in taxpayer information, reflecting a commitment to taxpayer compliance.

The Illinois Estimated Tax form (Form IL-1040-ES) is another document that resembles the West Virginia Estimated Tax form. Both forms require individuals to estimate their tax liabilities and make payments throughout the year. They include sections for personal information, payment amounts, and any changes in taxpayer details. Each form stresses the importance of timely payments to avoid penalties and provides guidance on how to calculate estimated taxes based on projected income, ensuring taxpayers are well-informed.

Lastly, the Pennsylvania Estimated Tax form (Form REV-421) shares characteristics with the West Virginia form. Both documents are used by individuals to report and pay estimated taxes. They require taxpayers to provide personal details and payment amounts based on expected income. Each form includes instructions on determining due dates and emphasizes the need for timely payments to prevent penalties. Furthermore, both forms allow for updates to personal information, ensuring that tax authorities have accurate records for each taxpayer.

Key Facts about West Virginia Estimated Tax

What is the West Virginia Estimated Tax form?

The West Virginia Estimated Tax form, known as WV/IT-140ES, is used by individuals who expect to owe at least $600 in state tax when filing their annual income tax return. This form allows taxpayers to make estimated tax payments throughout the year to avoid penalties at tax time.

Who needs to file the Estimated Tax form?

If you anticipate owing $600 or more in state taxes, you are required to file this form. This applies to individuals with income that is not subject to withholding, such as self-employment income, rental income, or interest income.

How do I determine my estimated tax amount?

To calculate your estimated tax, refer to the instruction brochure (Form IT-140ESI) available on the West Virginia State Tax Department's website. This brochure provides guidance on how to estimate your income and the tax owed based on your expected earnings.

When are estimated tax payments due?

Due dates for estimated tax payments depend on your tax year. If you are a calendar year taxpayer, payments are typically due on April 15, June 15, September 15, and January 15 of the following year. If you do not follow the calendar year, consult the instructions for specific due dates.

Can I pay more than the minimum amount?

Yes, you can pay more than the minimum amount calculated using the instructions. While it is important to pay at least the minimum to avoid penalties, making larger payments can help reduce your tax liability when you file your annual return.

What should I do if my address has changed?

If any information preprinted on the form is incorrect or has changed, check the box for "Change of Address" and complete the section with your updated information. This ensures that the West Virginia State Tax Department has your current mailing address.

Where do I mail my estimated tax payment?

Mail your completed Estimated Tax form and payment to the following address: West Virginia State Tax Department, Tax Account Administration Division - EST, P.O. Box 342, Charleston, WV 25322-0342. Ensure that you send your payment by the due date to avoid penalties.

What if I need assistance with the form?

If you require assistance, you can call the West Virginia State Tax Department at (304) 558-3333 or toll-free at (800) 982-8297. Their representatives can help answer any questions you may have regarding the Estimated Tax form or your tax situation.

Where can I find more information about the Estimated Tax form?

For more detailed information, visit the West Virginia State Tax Department's website at www.tax.wv.gov. You can also file your estimated tax payments online through their online portal at https://mytaxes.wvtax.gov.

Preview - West Virginia Estimated Tax Form

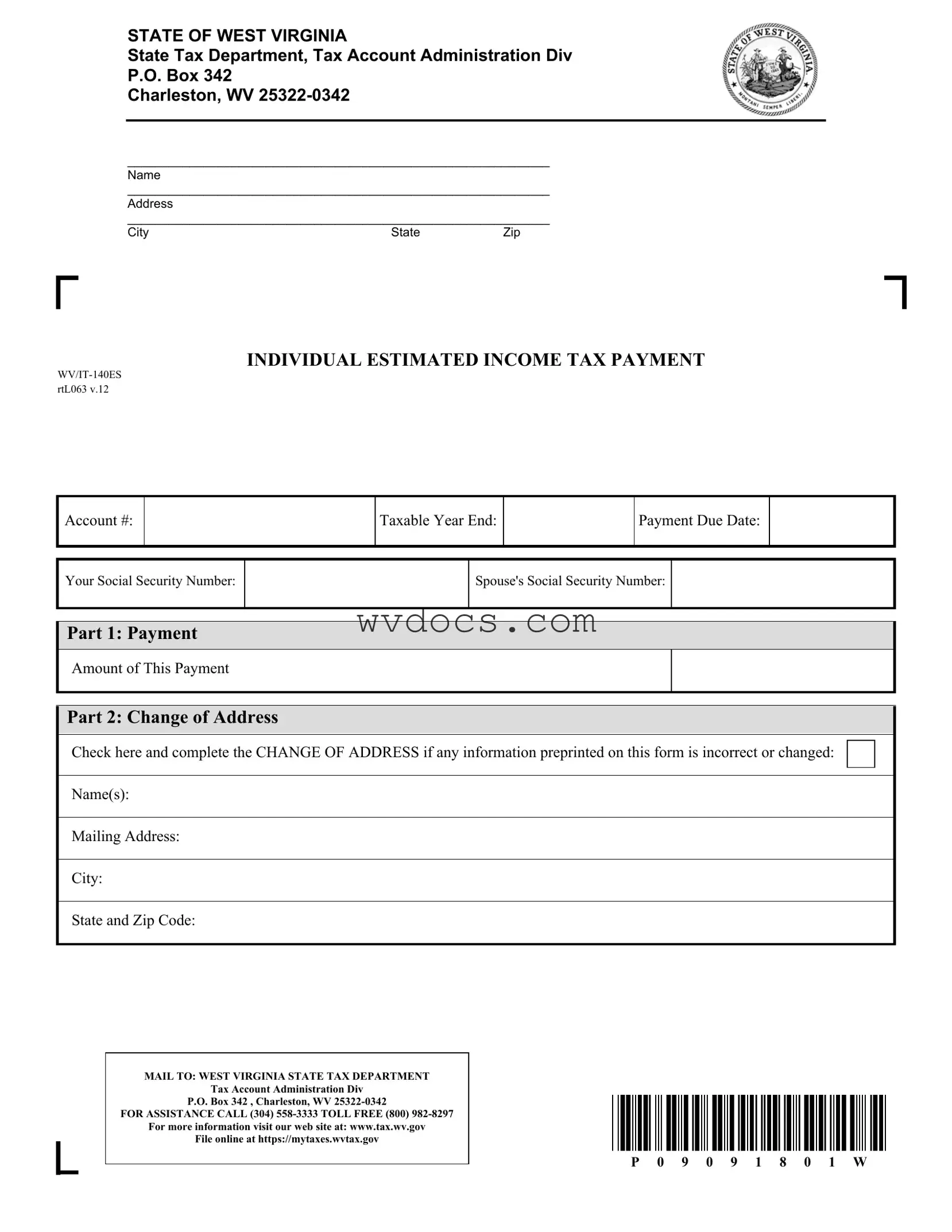

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 342

Charleston, WV

_____________________________________________________________ |

Letter Id: |

L0045367296 |

||

DONNA J. AAROE |

|

|

||

Name |

|

|

|

|

17 CLUB HOUSE DR |

|

|

Issued: |

02/01/2019 |

_____________________________________________________________ |

||||

EVANS WV |

|

|

Account #: |

|

Address |

|

|

|

|

_____________________________________________________________ |

Period: |

12/31/2018 |

||

City |

State |

Zip |

||

INDIVIDUAL ESTIMATED INCOME TAX PAYMENT

Account #:

Taxable Year End:

Payment Due Date:

Your Social Security Number:

Spouse's Social Security Number:

Part 1: Payment

Amount of This Payment

Part 2: Change of Address

Check here and complete the CHANGE OF ADDRESS if any information preprinted on this form is incorrect or changed:

Name(s):

Mailing Address:

City:

State and Zip Code:

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 342 , Charleston, WV

FOR ASSISTANCE CALL (304)

For more information visit our web site at: www.tax.wv.gov

File online at https://mytaxes.wvtax.gov

P 0 9 0 9 1 8 0 1 W

INSTRUCTIONS FOR MAKING ESTIMATED PAYMENTS

If you expect to owe at least $600 in State tax when you file your annual income tax return, you are required to make estimated tax payments using this form.

Determine your estimated tax using the instruction brochure (Form

Write the amount of your payment on this form. You must pay at least the minimum amount calculated using the instructions to avoid being penalized; however, you may pay more than the minimum if you wish.

Be sure to post your payment in the payment table. If you are not a calendar year taxpayer, you should see the instructions to determine the due dates of your payments.

Estimated tax payments should be mailed by the due date to:

State Tax Department

Tax Account Administration Division - EST P.O. Box 342

Charleston WV

Documents used along the form

The West Virginia Estimated Tax form is essential for individuals who expect to owe state taxes. However, several other forms and documents often accompany this form to ensure accurate tax reporting and compliance. Below is a list of related documents that may be necessary.

- West Virginia Individual Income Tax Return (Form IT-140): This is the primary form used to report income and calculate the total tax owed for the year. It is typically filed annually and includes all income sources, deductions, and credits.

- Texas Real Estate Purchase Agreement form: This legally binding document outlines the terms and conditions for real estate transactions in Texas, ensuring clarity and understanding between the buyer and seller. For more information, visit TopTemplates.info.

- West Virginia Estimated Tax Instructions (Form IT-140ESI): This brochure provides detailed guidance on how to calculate estimated tax payments. It outlines the necessary steps and considerations for determining the amount due.

- Change of Address Form: If there is a change in your mailing address, this form should be completed and submitted. Keeping your address updated ensures that you receive all relevant tax information and notices.

- Payment Voucher (Form WV/IT-140ES): This voucher is used to submit your estimated tax payment. It accompanies your payment and helps ensure that it is credited to the correct account.

Using these forms in conjunction with the West Virginia Estimated Tax form can help streamline the tax filing process. Ensuring accuracy and compliance with state tax regulations is crucial for avoiding penalties and making informed financial decisions.