Official West Virginia Gsr 01 Template in PDF

Key takeaways

Filling out the West Virginia GSR-01 form is an important step for businesses seeking a Statement of Good Standing. Here are some key takeaways to consider:

- Understand the Purpose: The GSR-01 form is used to request a Statement of Good Standing from the West Virginia State Tax Department. This document confirms that your business is compliant with state tax obligations.

- Complete Business Information: Ensure that you fill in the complete business name, location, and mailing address accurately. This information is crucial for the Tax Department to process your request.

- Identify Your Business Type: Check the appropriate box to indicate whether your business is a partnership, sole ownership, corporation, LLC, or other. This classification helps the Tax Department understand your business structure.

- Signature Requirements: The form must be signed by the taxpayer or an authorized representative. If a CPA or attorney is completing the form, a principal of the business must also sign.

- Notarization for Third Parties: If someone other than the taxpayer, CPA, or attorney is submitting the request, the form must be notarized. This step adds an extra layer of verification.

- Provide Contact Information: Include your phone number and email address. This allows the Tax Department to reach you easily if there are any questions or issues regarding your request.

- Know the Response Options: If you prefer to receive the response via fax, provide the fax number and the name of the person to whom the fax should be addressed. This ensures you get the information in a timely manner.

By keeping these takeaways in mind, you can navigate the GSR-01 form with confidence and ensure that your request is processed smoothly.

Additional PDF Templates

Wv Business Registration - Consulting the state’s website can provide guidance and additional information.

The Florida Operating Agreement form is a vital document for LLCs in the state, providing a framework for management and operational practices within the company. It helps delineate responsibilities and ownership among members, preventing potential conflicts. If you're in need of a reliable resource, check out this informative guide on the Operating Agreement for proper procedures and considerations.

Wv State Tax Forms - Estimated payments can help prevent a larger tax liability at the end of the year, promoting better financial planning.

How to Become a Resident of West Virginia - The effective use of the Opt 1 form can result in a smoother filing experience.

Misconceptions

Here are eight common misconceptions about the West Virginia GSR-01 form, along with clarifications for each.

- Misconception 1: The GSR-01 form is only for corporations.

- Misconception 2: You do not need to sign the form if you are a CPA or attorney.

- Misconception 3: The form guarantees that the business is in good standing.

- Misconception 4: You can submit the form without a notary if you are not the taxpayer.

- Misconception 5: The form can be submitted without providing a fax number.

- Misconception 6: The GSR-01 form is only needed when applying for a business license.

- Misconception 7: You can fill out the form without any business identification numbers.

- Misconception 8: Once submitted, the form cannot be amended.

This form is used by various business types, including partnerships, sole proprietorships, and LLCs. It is not limited to corporations.

Even if you are a CPA or attorney completing the form, the principal of the business must also sign it. This ensures proper authorization.

Submitting the GSR-01 form does not guarantee good standing. It is a request for a statement, and you will be notified if there are any issues.

If someone other than the taxpayer, CPA, or attorney is submitting the form, it must be notarized. This is a requirement for proper validation.

While providing a fax number is optional, it can expedite the process if you prefer to receive the response by fax.

This form is useful for various situations beyond licensing, including verifying tax compliance and good standing with the state.

A Taxpayer Identification Number is required on the form. This helps the Tax Department identify your business accurately.

If you make a mistake on the GSR-01 form, you can submit a new request. However, it's best to double-check for accuracy before sending it in.

Similar forms

The West Virginia GSR-01 form, which requests a Statement of Good Standing, shares similarities with the Certificate of Good Standing. This document is typically issued by a state’s Secretary of State and verifies that a business entity is compliant with state regulations and has met all filing requirements. Like the GSR-01, the Certificate of Good Standing is often required for various business transactions, such as securing loans or entering contracts. Both documents serve to assure third parties that the business is operating legally and responsibly.

Another document that resembles the GSR-01 is the Certificate of Existence. This certificate confirms that a business is legally registered and recognized by the state. It includes essential information such as the business's name, formation date, and status. Much like the GSR-01, the Certificate of Existence is often needed for business dealings, such as opening bank accounts or applying for permits. Both documents provide proof of a business’s standing and compliance with state laws.

The West Virginia Business License is also comparable to the GSR-01 form. This license is required for many businesses to operate legally within the state. It indicates that a business has met local regulations and has permission to conduct its operations. Just as the GSR-01 confirms good standing with tax obligations, the Business License demonstrates compliance with local laws and regulations, making it essential for maintaining a lawful business presence.

Similarly, the Articles of Incorporation serve a parallel purpose. These documents are filed with the state to legally establish a corporation. They outline key details such as the business name, address, and purpose. While the GSR-01 focuses on the current standing of a business regarding tax compliance, the Articles of Incorporation provide foundational information about the business’s formation and structure. Both are critical for ensuring a business operates within the legal framework of the state.

The Texas Real Estate Purchase Agreement form is an essential document for anyone navigating property transactions in Texas, and it is important to understand its specifics and legal implications. For more guidance, you can refer to resources such as TopTemplates.info, which provide insights into creating and managing these agreements effectively.

The Tax Clearance Certificate is another document that aligns with the GSR-01. This certificate confirms that a business has no outstanding tax liabilities with the state. Like the GSR-01, it is often required when a business is involved in transactions like selling property or applying for loans. Both documents assure stakeholders that the business is in good standing with tax authorities and has fulfilled its financial obligations.

Lastly, the Business Registration Certificate is similar to the GSR-01 in that it verifies a business's legal registration with the state. This certificate is proof that a business has completed the necessary steps to operate legally. Just as the GSR-01 confirms ongoing compliance with tax requirements, the Business Registration Certificate indicates that the business has met the initial legal requirements to start operating. Both documents are essential for establishing credibility and trust with customers and partners.

Key Facts about West Virginia Gsr 01

What is the West Virginia GSR-01 form?

The West Virginia GSR-01 form is a Request for Statement of Good Standing. It allows businesses to request confirmation from the West Virginia State Tax Department that they are in good standing regarding their tax obligations. This form is essential for businesses to ensure compliance and maintain their good standing status.

Who needs to fill out the GSR-01 form?

This form should be filled out by the business owner or an authorized representative, such as a CPA or attorney. If someone other than the taxpayer is completing the form, that individual must also have the taxpayer's signature and, in some cases, the form must be notarized.

What information is required on the GSR-01 form?

You will need to provide your Taxpayer Identification Number, complete business name, business location, and mailing address. Additionally, you must indicate the type of business—whether it's a partnership, sole ownership, corporation, LLC, or other. Lastly, signatures from the taxpayer and any authorized representatives are required.

What happens if my business is not in good standing?

If your business is not in good standing, the West Virginia State Tax Department will notify you in writing. This notification will specify which tax returns or payments are missing and provide contact information for any questions you may have regarding the situation.

Do I need a notary for the GSR-01 form?

A notary is required if someone other than the taxpayer, CPA, or attorney is signing the form. This ensures that the request is legitimate and that the person signing has the authority to do so.

How can I submit the GSR-01 form?

You can send the completed form to the West Virginia State Tax Department via mail or fax. The mailing address is PO Box 885, Charleston, WV 25323-0885. If you choose to fax the form, use the fax number (304) 558-8643. Make sure to include any necessary signatures and information to avoid delays.

How long does it take to receive a response after submitting the GSR-01 form?

The response time may vary, but you can generally expect to receive a reply within a few weeks. If you need the response sooner, you can include a fax number on the form to receive it more quickly.

What should I do if I have questions about the GSR-01 form?

If you have any questions regarding the GSR-01 form or the process, you can contact the West Virginia State Tax Department directly. Their phone numbers include (304) 558-0678 and (304) 558-8695 for inquiries related to excise and support taxes.

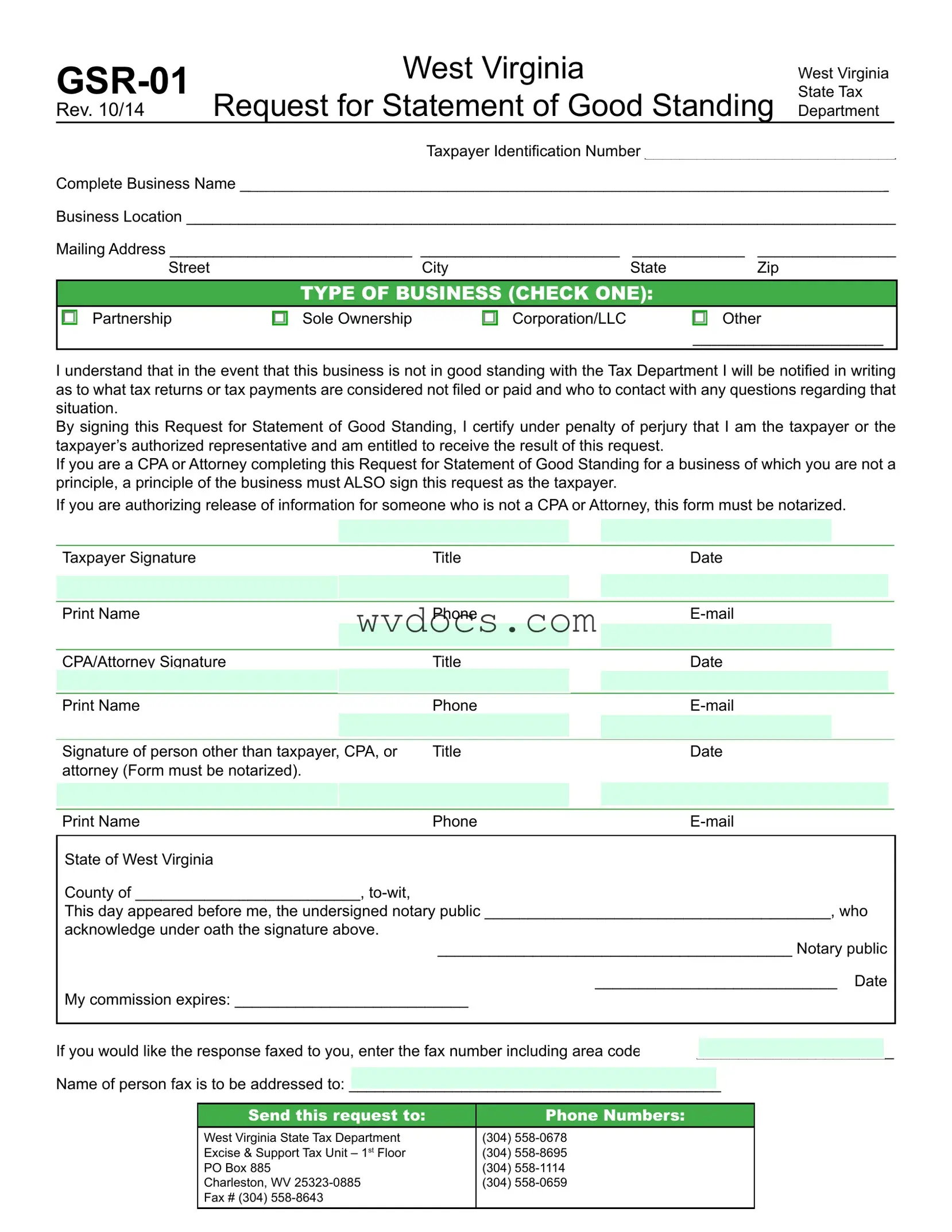

Preview - West Virginia Gsr 01 Form

West Virginia |

||

Request for Statement of Good Standing |

||

Rev. 10/14 |

West Virginia

State Tax

Department

Taxpayer Identiication Number _____________________________

Complete Business Name ___________________________________________________________________________

Business Location __________________________________________________________________________________

Mailing Address ____________________________ _______________________ |

_____________ |

________________ |

|

Street |

City |

State |

Zip |

Type of business (check one):

Partnership

Sole Ownership

Corporation/LLC

Other

______________________

I understand that in the event that this business is not in good standing with the Tax Department I will be notiied in writing as to what tax returns or tax payments are considered not iled or paid and who to contact with any questions regarding that

situation.

By signing this Request for Statement of Good Standing, I certify under penalty of perjury that I am the taxpayer or the taxpayer’s authorized representative and am entitled to receive the result of this request.

If you are a CPA or Attorney completing this Request for Statement of Good Standing for a business of which you are not a principle, a principle of the business must ALSO sign this request as the taxpayer.

If you are authorizing release of information for someone who is not a CPA or Attorney, this form must be notarized.

Taxpayer Signature |

Title |

|

Date |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Print Name |

Phone |

|

|||||

|

|

|

|

|

|

|

|

CPA/Attorney Signature |

|

Title |

|

Date |

|||

|

|

|

|

|

|

|

|

Print Name |

Phone |

|

|||||

|

|

|

|

|

|

|

|

Signature of person other than taxpayer, CPA, or |

Title |

|

Date |

||||

attorney (Form must be notarized). |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Print Name |

Phone |

|

|||||

State of West Virginia

County of __________________________,

This day appeared before me, the undersigned notary public ________________________________________, who

acknowledge under oath the signature above.

_________________________________________ Notary public

____________________________ Date

My commission expires: ___________________________

If you would like the response faxed to you, enter the fax number including area code ( |

) |

______________________ |

_ |

||||||

|

|||||||||

Name of person fax is to be addressed to: |

___________________________________________ |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

send this request to: |

|

phone numbers: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

West Virginia State Tax Department |

(304) |

|

|

|

|

|

||

|

Excise & Support Tax Unit – 1st Floor |

(304) |

|

|

|

|

|

||

|

PO Box 885 |

(304) |

|

|

|

|

|

||

|

Charleston, WV |

(304) |

|

|

|

|

|

||

|

Fax # (304) |

|

|

|

|

|

|

|

|

Documents used along the form

The West Virginia GSR 01 form is essential for businesses seeking a statement of good standing from the state tax department. Alongside this form, several other documents may be required or useful in various business transactions or compliance matters. Below is a list of related forms and documents that are commonly used in conjunction with the GSR 01.

- Business Registration Certificate: This document proves that a business is officially registered with the state. It includes details such as the business name, type, and registration date.

- Tax Clearance Certificate: This certificate indicates that a business has paid all its taxes and is in good standing with the tax authorities. It is often required for bidding on contracts or applying for loans.

- Operating Agreement: For LLCs, this internal document outlines the management structure and operating procedures of the business. It helps clarify the roles and responsibilities of members.

- Bylaws: Corporations must have bylaws, which serve as the rules governing the management of the corporation. They detail the duties of officers, how meetings are conducted, and how decisions are made.

- Annual Report: Many states require businesses to file an annual report to maintain good standing. This report typically includes updated information about the business, such as its address and key officers.

- Employer Identification Number (EIN): This number, issued by the IRS, is necessary for tax purposes. It is used to identify the business entity and is required for hiring employees or opening a business bank account.

- Certificate of Good Standing: This document, often obtained from the Secretary of State, confirms that a business is legally registered and compliant with state regulations.

- ATV Bill of Sale: This form is essential for the sale and transfer of an all-terrain vehicle in New York, ensuring all necessary details are recorded. More information can be found at smarttemplates.net.

- Partnership Agreement: If the business is a partnership, this document outlines the terms of the partnership, including profit sharing, responsibilities, and dispute resolution methods.

- Notarized Authorization Letter: If someone other than the business owner is requesting information, a notarized letter authorizing that person to act on behalf of the business may be required.

Understanding these documents can help streamline the process of maintaining compliance and ensuring that a business operates smoothly within the legal framework. Each document serves a specific purpose, contributing to the overall health and legality of the business entity.