Official West Virginia It 140X Template in PDF

Key takeaways

When filling out and using the West Virginia IT-140X form, consider the following key takeaways:

- Purpose of the Form: The IT-140X form is specifically designed for amending a West Virginia income tax return for taxable years 2003 through 2006.

- Filing Requirements: You must file this form within 90 days of any changes made to your federal income tax return or if you amend your federal return.

- Residency Status: Clearly indicate your residency status on the form, as it affects how your tax is calculated. This includes options for full-year residents, nonresidents, and part-year residents.

- Supporting Documentation: Attach all necessary supporting documents, such as W-2s or 1099s, and any corrected schedules if you are making adjustments to your income or credits.

- Signature Requirement: Ensure that all required signatures are included on the form. If filing jointly, both spouses must sign the return for it to be processed.

Additional PDF Templates

West Virginia Police Report - Double-check your payment method to ensure it complies with the requirement outlined.

Having an Emotional Support Animal Letter form is crucial for individuals seeking the comfort of their ESA, as it not only outlines the necessity of the animal in their treatment but also helps to navigate legal frameworks associated with ownership. For those looking to obtain such a letter, resources like OnlineLawDocs.com can provide essential information and guidance throughout the process.

Wv Court Forms - Attach all required documents in the specified order to complete your appeal submission.

Misconceptions

- Form IT-140X is only for 2003 to 2006 tax years. Many people mistakenly believe that the form can be used for any tax year. However, it is specifically designated for the years 2003 through 2006.

- Only residents can file Form IT-140X. This is incorrect. Nonresidents and part-year residents can also use this form to amend their West Virginia income tax returns.

- You must file Form IT-140X immediately after filing your original return. In fact, you have a 90-day window after any federal changes to notify the West Virginia State Tax Department.

- Amending a joint return requires both spouses to file separately. This is misleading. If you amend a jointly filed return to file separately, only one spouse needs to file the amended return while the other must also file separately.

- Form IT-140X does not require supporting documents. This is not true. Any changes made on the form must be supported by relevant schedules and forms, or they may be disallowed.

- Filing status changes do not need to comply with federal regulations. This is incorrect. Changes in filing status must comply with federal regulations to be valid.

- All changes can be made without explanation. This is false. Each adjustment requires a clear explanation on Part II of the form.

- Form IT-140X can be submitted electronically. Many believe this to be true, but as of now, it must be mailed to the West Virginia State Tax Department.

- There is no deadline for submitting Form IT-140X. This is a misconception. There is a strict deadline of 90 days following any federal adjustments or amendments.

Similar forms

The West Virginia IT-140 form is similar to the IRS Form 1040, the standard individual income tax return used in the United States. Both forms collect essential personal information, including the taxpayer's name, address, and Social Security number. They require details about income, deductions, and credits. The IT-140 serves West Virginia residents, while the 1040 is for federal tax obligations. Each form allows taxpayers to report their financial situation accurately and claim any applicable credits or deductions, ensuring compliance with tax laws.

Another document similar to the IT-140 is the IRS Form 1040X, which is used to amend a previously filed federal tax return. Like the IT-140X, it allows taxpayers to make corrections to their income, deductions, or filing status. Both forms require a clear explanation of the changes made and necessitate supporting documentation. While the IT-140X specifically addresses West Virginia state taxes, the 1040X focuses on federal tax adjustments, making them essential for anyone needing to amend their tax filings.

The IT-140X also resembles the West Virginia IT-140NR, which is the nonresident income tax return. This form is for individuals who earned income in West Virginia but did not reside there for the entire tax year. Similar to the IT-140X, the IT-140NR requires detailed income reporting and allows for specific deductions related to West Virginia sources. Both forms ensure that taxpayers accurately report their income and pay the correct amount of tax based on their residency status.

For those interested in structuring their business, the comprehensive Florida Operating Agreement is a key resource that outlines the foundational elements necessary for a successful LLC operation.

Additionally, the IT-140X is comparable to the IRS Form 8862, which is used to claim the Earned Income Credit (EIC) after it has been disallowed in a previous year. Both forms require taxpayers to provide information about their income, filing status, and dependents to determine eligibility for tax credits. The IT-140X allows West Virginia residents to adjust their tax returns, while the 8862 helps individuals reclaim credits they may have missed, fostering accurate tax reporting and compliance.

The West Virginia IT-140X is also similar to the IRS Form 8888, which allows taxpayers to split their tax refund among multiple accounts. While the IT-140X focuses on amending returns, both forms address the financial aspects of tax filing. Taxpayers can use the IT-140X to correct previous mistakes, and the 8888 helps them manage their refunds effectively. Both forms promote better financial planning and tax management for individuals.

Another related document is the West Virginia IT-140NRS, which is a special return for nonresidents. This form is specifically for individuals who have income from West Virginia sources but do not meet the criteria for full residency. The IT-140X and IT-140NRS both require detailed income reporting and adjustments based on residency status. They ensure that nonresidents pay the appropriate amount of tax for their West Virginia income, just as the IT-140X allows residents to correct their tax filings.

Lastly, the IT-140X is akin to the West Virginia IT-140S, which is used by S corporations to report income, deductions, and credits. While the IT-140X is for individual taxpayers, both forms require detailed financial reporting and compliance with state tax laws. They ensure that all income earned within West Virginia is accurately reported and taxed accordingly, whether it’s for individual taxpayers or business entities.

Key Facts about West Virginia It 140X

What is the purpose of the West Virginia IT-140X form?

The West Virginia IT-140X form is designed for individuals who need to amend their previously filed West Virginia income tax returns. This includes corrections to income, filing status, exemptions, or credits. It can only be used for tax years 2003 through 2006. If there has been a change in your federal adjusted gross income, you are required by law to notify the West Virginia State Tax Department within 90 days of that change by filing this amended return.

Who should use the IT-140X form?

This form should be utilized by taxpayers who have already filed their original West Virginia income tax return and need to make amendments. This includes both residents and non-residents of West Virginia. Specific instructions apply if you are changing from a joint return to a separate return or vice versa. Ensure that both spouses file their returns correctly if amending a jointly filed return.

How do I complete the IT-140X form?

To complete the IT-140X form, start by entering your personal information, including names, addresses, and social security numbers. Follow the instructions line by line. Enter the original amounts from your prior return in Column A, the changes in Column B, and the corrected amounts in Column C. Be sure to explain any adjustments in Part II of the form and attach any necessary schedules or forms. If you are a non-resident or part-year resident, you must also complete Part III for tax calculations.

Where do I send my completed IT-140X form?

Once you have completed the IT-140X form, mail it to the West Virginia State Tax Department, Revenue Division, P.O. Box 1071, Charleston, WV 25324-1071. Ensure that you include any supporting documents required for the changes you are making. If you are making a payment, include a check or money order made out to the West Virginia State Tax Department, or you may opt to pay via credit or debit card.

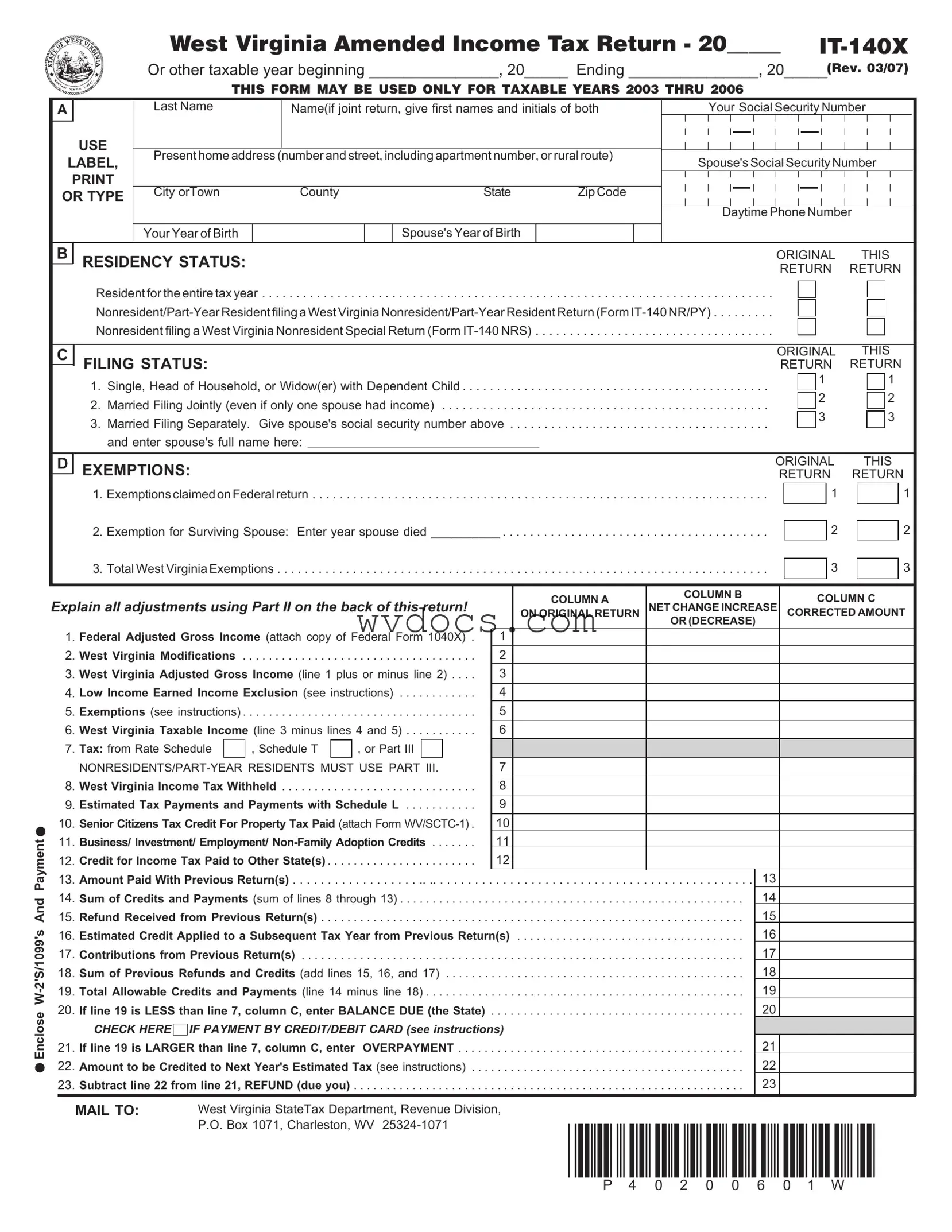

Preview - West Virginia It 140X Form

West Virginia Amended Income Tax Return - 20_____

Or other taxable year beginning _______________, 20_____ Ending _______________, 20_____(Rev. 03/07)

THIS FORM MAY BE USED ONLY FOR TAXABLE YEARS 2003 THRU 2006

A

USE

LABEL,

OR TYPE

Last Name |

Name(if joint return, give first names and initials of both |

|||||

|

|

|

|

|

|

|

Present home address (number and street, including apartment number, or rural route) |

||||||

|

|

|

|

|

|

|

City orTown |

County |

State |

ZipCode |

|||

|

|

|

|

|

|

|

Your Year of Birth |

|

|

|

Spouse's Year of Birth |

|

|

|

|

|

|

|

|

|

Your Social Security Number

Spouse'sSocialSecurityNumber

Daytime Phone Number

B

RESIDENCY STATUS:

Resident for the entire tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Nonresident filing a West Virginia Nonresident Special Return (Form

ORIGINAL THIS RETURN RETURN

C

FILING STATUS:

1. Single, Head of Household, or Widow(er) with Dependent Child . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Married Filing Jointly (even if only one spouse had income) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Married Filing Separately. Give spouse's social security number above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

and enter spouse's full name here:

ORIGINAL |

THIS |

RETURN |

RETURN |

1 |

1 |

2 |

2 |

3 |

3 |

D

EXEMPTIONS: |

ORIGINAL |

|

THIS |

|||

RETURN |

RETURN |

|||||

1. ExemptionsclaimedonFederalreturn |

|

|

|

|

|

1 |

|

|

1 |

|

|

||

2. Exemption for Surviving Spouse: Enter year spouse died __________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2

3. Total West Virginia Exemptions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3

Enclose

|

COLUMN A |

COLUMN B |

COLUMN C |

|

Explain all adjustments using Part II on the back of this return! |

NET CHANGE INCREASE |

|||

ON ORIGINAL RETURN |

CORRECTED AMOUNT |

|||

|

|

OR (DECREASE) |

|

1.Federal Adjusted Gross Income (attach copy of Federal Form 1040X) . 1

2. |

West Virginia Modifications |

. . . |

. |

. . . . . . . . . . |

. . . |

. . . . . |

|

|

2 |

|

|

||

3. |

West Virginia Adjusted Gross Income (line 1 plus or minus line 2) . . . . |

|

3 |

|

|

||||||||

4. |

Low Income Earned Income Exclusion (see instructions) |

4 |

|

|

|||||||||

5. |

Exemptions (see instructions) |

. . . |

. |

. . . . . . . . . . |

. . . |

. . . . . |

|

|

5 |

|

|

||

6. |

West Virginia Taxable Income (line 3 minus lines 4 and 5) |

6 |

|

|

|||||||||

7. |

Tax: from Rate Schedule |

|

, Schedule T |

|

|

, or Part III |

|

|

|

|

|

|

|

|

7 |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

West Virginia Income Tax Withheld |

. . . |

. . . . . |

|

|

8 |

|

|

|||||

9. |

Estimated Tax Payments and Payments with Schedule L |

|

9 |

|

|

||||||||

10. |

Senior Citizens Tax Credit For Property Tax Paid (attach Form |

|

10 |

|

|

||||||||

11. |

Business/ Investment/ Employment/ |

11 |

|

|

|||||||||

12. |

Credit for Income Tax Paid to Other State(s) |

. . . |

. . . . . |

|

|

12 |

|

|

|||||

13. |

Amount Paid With Previous Return(s) |

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

13 |

|

||||||||

14. |

Sum of Credits and Payments (sum of lines 8 through 13) |

14 |

|

||||||||||

15. |

Refund Received from Previous Return(s) |

. . . |

. . . . . . . |

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

15 |

|

||||||

16. |

Estimated Credit Applied to a Subsequent Tax Year from Previous Return(s) |

16 |

|

||||||||||

17. |

Contributions from Previous Return(s) |

. . . |

. . . . . . . |

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

17 |

|

||||||

18. |

Sum of Previous Refunds and Credits (add lines 15, 16, and 17) |

18 |

|

||||||||||

19. |

Total Allowable Credits and Payments (line 14 minus line 18) |

19 |

|

||||||||||

20. |

If line 19 is LESS than line 7, column C, enter BALANCE DUE (the State) |

20 |

|

||||||||||

|

CHECK HERE IF PAYMENT BY CREDIT/DEBIT CARD (see instructions) |

|

|

||||||||||

21. |

If line 19 is LARGER than line 7, column C, enter |

OVERPAYMENT |

21 |

|

|||||||||

22. |

Amount to be Credited to Next Year's Estimated Tax (see instructions) |

22 |

|

||||||||||

23. |

Subtract line 22 from line 21, REFUND (due you) . |

. . . . . . . . . . |

. . . |

. . . . . . . |

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

23 |

|

|||||

MAIL TO: West Virginia StateTax Department, Revenue Division,

P.O. Box 1071, Charleston, WV

*P40200601W*

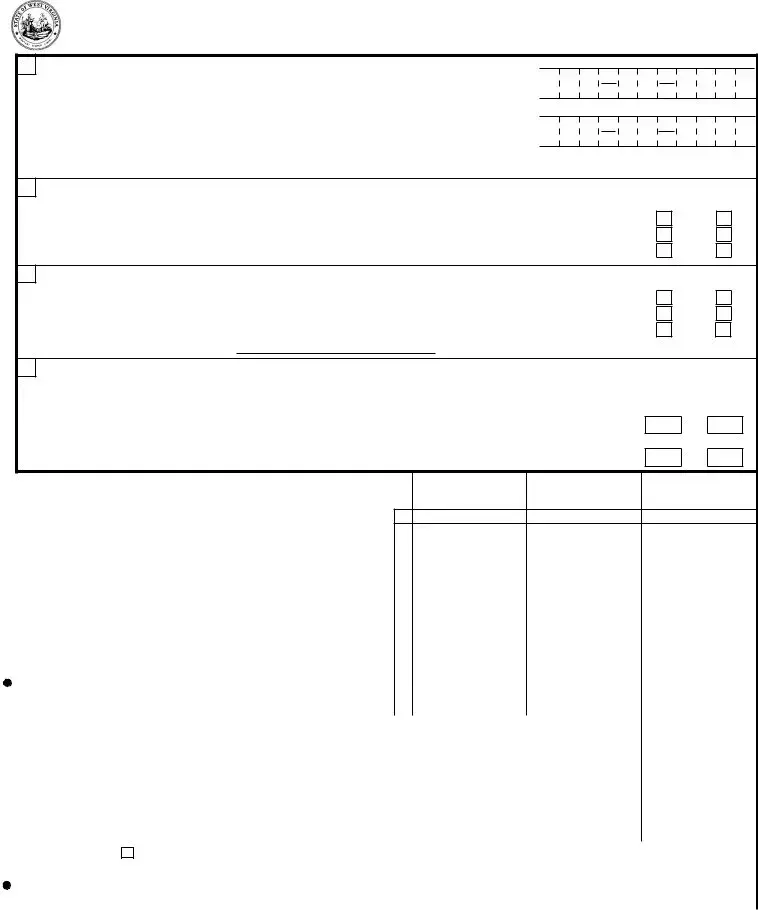

PART I: TAX RATE SCHEDULES

|

|

RATE SCHEDULE I |

|

|

RATE SCHEDULE II |

||||

|

|

|

|

|

|

||||

Single, Married filing jointly, Head of household, and Widow(er) |

Married |

filing separately |

|

|

|

||||

with dependent |

child |

|

|

|

|

|

|

|

|

Use this schedule if you checked box number 1 or 2 under "FILING STATUS" |

Use this schedule if you checked box number 3 under "FILING STATUS" |

||||||||

Less than $10,000 |

. . . . . . |

. . . . . . . . . 3% of the taxable income |

Less than $5,000 . . . |

. . . . |

. . . . . . . . . |

3% of the taxable income |

|||

At least- |

But less than− |

|

At least− |

But less than− |

|

|

|

|

|

$10,000 |

$25,000 |

. . . . . . . $ |

300.00 plus 4% of excess over $10,000 |

$ 5,000 |

$12,500 . . . . |

. . . $ |

150.00 plus 4% |

of excess over $ 5,000 |

|

$25,000 |

$40,000 |

. . . . . . . $ |

900.00 plus 4.5% of excess over $25,000 |

$12,500 |

$20,000 . . . . |

. . . $ |

450.00 plus 4.5% |

of excess over $12,500 |

|

$40,000 |

$60,000 |

. . . . . . . $1,575.00 plus 6% of excess over $40,000 |

$20,000 |

$30,000 . . . . |

. . . $ |

787.50 plus 6% |

of excess over $20,000 |

||

$60,000 |

|

. . . . . . . $2,775.00 plus 6.5% of excess over $60,000 |

$30,000 |

. . . . |

. . . $1,387.50 plus 6.5% |

of excess over $30,000 |

|||

|

|

|

|

|

|

|

|

|

|

PART II: EXPLANATION OF CHANGES TO INCOME, STATUS, EXEMPTIONS, AND CREDITS

Enter the box or line number from the front of this form for each item you are changing and give the reason for each change. Attach all supporting forms and schedules for items changed. Be sure to include your name and social security number on any attachments.

PART III:

|

|

1 |

1. |

Tentative Tax (apply the rate schedules above to the amount shown in column C, line 6) |

|

|

IF YOU WERE SUBJECT TO FEDERAL MINIMUM TAX, USE SCHEDULE T TO CALCULATE |

|

|

YOUR TAX (ATTACH SCHEDULE T TO YOUR RETURN). |

|

2.West Virginia Income (include all income during your period of residency and any

|

|

2 |

|

West Virginia source income during your nonresidency; see the instructions) |

|

3. |

Federal Adjusted Gross Income (from column C, line 1) |

3 |

|

|

4 |

4. |

Tax (divide line 2 by line 3, and multiply the result by line 1; enter here and in Column C, line 7) |

. . . . . . . . . . . . . . . . . . . . |

|

If you are claiming a federal net operating loss carryback, you must continue to Part IV. |

|

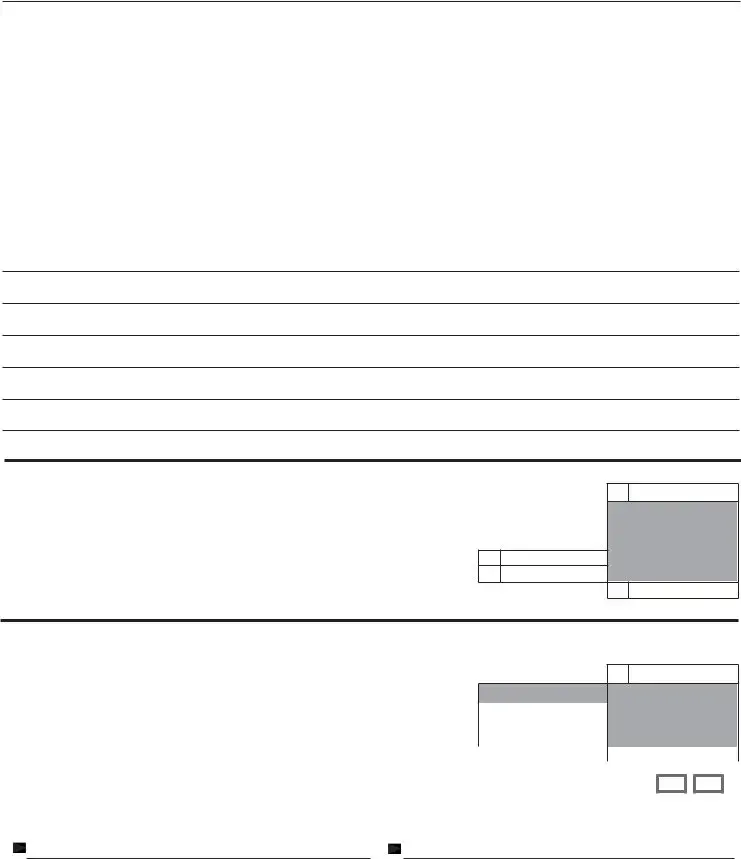

PART IV:

NET OPERATING LOSS CARRYBACK

|

|

5 |

5. |

Subtract line 2 Part III from your original Federal Adjusted Gross Income (line1, Column A) |

|

6.Income Percentage (Divide line 5 by line 3 Part III and round the result to four decimal places)

|

Note: decimal cannot exceed 1.0000 |

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Multiply line 1 Part III by the line 6 decimal |

7 |

|

|

|

|

|

8. |

Subtract line 7 from line 1 Part III |

8 |

|

|

|

|

|

9. |

West Virginia Tax (Enter the smaller of line 4 Part III or line 8 here and on Page 1, line 7, column C and check Part IV) . . |

9 |

|

|

|||

|

|

|

|

||||

My/our initials in the boxes indicate waiver of my/our rights of confidentiality for the purpose of contacting the preparer regarding this return.

SIGN HERE - Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief it is true, correct, and complete.

Your Signature |

Date |

|

|

Signature of preparer other than taxpayer |

Date |

Spouse's Signature |

Date |

|

|

|

|

Address of preparer |

Daytime Phone Number |

Rev. 05/04

AMENDEDWESTVIRGINIAPERSONALINCOMETAXRETURN

GENERAL INFORMATION

CHANGES IN YOUR FEDERAL ADJUSTED GROSS INCOME. If the Federal Government makes any change to your Federal income tax return, you are required by law to notify the West Virginia State Tax Department of the change within ninety (90) days after the final determination of such change. If you file an amended Federal income tax return, you are required by law to file an amended West Virginia State income tax return within ninety (90) days thereafter.

WHERE TO OBTAIN FORMS AND INFORMATION. Forms and instructions may be obtained by visiting our web site at www.state.wv.us/taxdiv or by calling our Interactive Voice Response System at (304)

WHEN SHOULD FORM

SPECIAL INSTRUCTIONS FOR AMENDING A JOINTLY OR SEPARATELY FILED RETURN. If your original return was filed jointly and you are amending to file separately, your spouse must also file a separate return. If your original filing was married filing separately and you are now amending to file jointly, Column A should reflect only the primary taxpayer’s original filing. If you are changing your filing status from married filing jointly to married filing separately or from married filing separately to married filing jointly you MUST do so in compliance with federal regulations.

SCHEDULES. If any change is made on line 2 (Schedule M), line 7 (Schedule T), line 10

HOW TO COMPLETE FORM

STEP 1

Section A - Type or print your name(s), address, and social security number(s) legibly in the spaces provided. Year of birth: Enter the years in which you and your spouse, if joint return, were born. Telephone number: Enter the telephone number where you can be reached during the day.

Section B - Check only one in each column. If you were not a resident of West Virginia for the entire taxable year, you must use Part III on the back of the form to calculate your West Virginia tax.

Section C - Check only one in each column. If you are married but filing separate returns, enter your spouse’s name in the space provided and his/ her social security number in Section A.

Section D - (Block 1) If your filing status is the same on your State return as on your Federal return, enter the total number of exemptions claimed on the Federal return. If you claimed “0” exemptions on your Federal return, you must claim “0” on your State return. If you are married filing a joint Federal return but separate State returns, enter the total number of exemptions you would have been entitled to claim if you had filed separate Federal returns. (Block 2) If you are eligible to claim an additional exemption as a surviving spouse, list year of spouse’s death and enter “1” in block 2.

(Block 3) If you claimed an exemption in block 2 for being a surviving spouse, add blocks 1 and 2 and enter the result in block 3. Otherwise, enter in block 3 the number of Federal exemptions claimed in block 1.

STEP 2

Complete lines 1 through 22 of

line instructions:

or as you later amended it. If your return was changed or audited, enter the amounts as adjusted.

COLUMN B - Enter the net increase or net decrease for each line you are changing. Bracket all decreases. Explain each change on page 2, Part II, and attach any related schedules or forms. If you need more space, show the required information on an attached statement.

COLUMN C - Add the increase in column B to the amount in column A, or subtract the column B decrease from column A. Show the result in column

C.Bracket all decreases. For any item you do not change, enter the amount from column A in column C.

LINE 1: FEDERAL ADJUSTED GROSS INCOME. Enter your Federal adjusted gross income.

LINE 2: MODIFICATION(S) TO INCOME. Enter the net plus or minus amount of income modification. If your modification is being adjusted, you must attach a corrected schedule M, which may be obtained from the Taxpayer Services Division.

LINE 3: WEST VIRGINIA ADJUSTED GROSS INCOME. Enter the result of line 1 plus or minus line 2.

LINE 4:

If you are eligible for the exclusion and need the

LINE 5: EXEMPTIONS. Multiply the number entered in Section D, Block 3, by $2,000 and enter the result on line 5. If you claimed zero exemptions, enter $500 on line 5.

LINE 6: WEST VIRGINIA TAXABLE INCOME. Subtract lines 4 and 5 from

line 3 and enter the result on line 6.

LINE 7: WEST VIRGINIA INCOME TAX. If you are a resident and marked filing status “1” or "2" in Section C, you must use Rate Schedule I (on page 2, part I) to compute your tax to be entered on line 7; if you marked filing status “3” in Section C, use Rate Schedule II (on page 2, part I) to compute your tax to be entered on line 7. If you are a nonresident or a

Federal Alternative Minimum Tax- If you are subject to the Federal Alternative Minimum Tax, place an “X” in the box provided and use Schedule T to compute your total West Virginia Income Tax. Schedule T applies to both residents and nonresidents.

LINE 8: WEST VIRGINIA INCOME TAX WITHHELD. Enter the amount of West Virginia tax withheld from your wages. If you change these amounts, attach a copy of all additional or corrected forms

LINE 9: ESTIMATED TAX PAYMENTS AND/OR SCHEDULE L PAYMENTS.

Enter the total amount of estimated tax payments paid by you (and spouse, if joint return) for the taxable year you are amending. Be certain to claim any overpayment that you requested to be applied to your tax and/or any payment made with your West Virginia application for extension of time to file (Schedule L) on your original return.

LINE 10: SENIOR CITIZEN TAX CREDIT FOR PROPERTY TAX PAID. Enter

the amount of allowable credit from Form

COLUMN A - Enter the amounts from your return as originally filed

LINE 11:

TION CREDITS. If you are claiming one or more of these credits, enter the total of such credits on line 10. If you are changing this amount you must attach the appropriate corrected schedule(s). The schedules and instructions are available upon request to the Taxpayer Services Division. Failure to attach corrected schedule(s) to your return will result in any claimed credit being disallowed.

LINE 12: INCOME TAX PAID OTHER STATE(S). Enter your available Schedule E credit. If you are changing this amount, a corrected Schedule E and a copy of the income tax return filed with the state for which you are claiming credit MUST be attached to your Form

LINE 13: AMOUNT PAID WITH PREVIOUS RETURN(S). Enter the total amount paid with your original and any previous amended return(s).

LINE 14: SUM OF CREDITS AND PAYMENTS. Add lines 8 through 13 and

enter the result.

LINE 15: REFUNDS RECEIVED FROM PREVIOUS RETURN(S). The total amount of refunds received from your original and any previous amended return(s) must be entered on line 15, to be deducted from your total credits on line 14.

LINE 16: ESTIMATED CREDIT APPLIED TO A SUBSEQUENT TAX YEAR

FROM PREVIOUS RETURN(S). The total amount of estimated credit applied to a subsequent year from your original and any previous amended return(s) must be entered on line 16, to be deducted from your total credits on line 14.

LINE 17: CONTRIBUTIONS FROM PREVIOUS RETURN(S). The total amount of any contributions made with your original and any previous amended return(s) must be entered on line 17, to be deducted from your total credits on line 14.

LINE 18: TOTAL OF YOUR PREVIOUS REFUNDS AND CREDITS. Add lines

15, 16 and 17 and enter the result.

LINE 19: TOTAL ALLOWABLE CREDITS AND PAYMENTS. Subtract line 18 from line 14 and enter the result.

LINE 20: BALANCE DUE. If your total tax (line 7) is larger than your total allowable credits and payments (line 19), enter the difference as the Balance Due the State of West Virginia. A check or money order for the total balance due must be made payable to the West Virginia State Tax Department. Use your credit card! It's easy. Just call

LINE 21: OVERPAYMENT. If your total allowable credits and payments (line

19)is larger than your total tax (line 7), enter the difference as the overpayment due you.

LINE 22: AMOUNT TO BE CREDITED TO NEXT YEAR'S ESTIMATED TAX.

YOU MAY USE THIS OPTION ONLY IF YOU HAVE NOT PREVIOUSLY FILED A RETURN FOR THE TAX YEAR TO RECEIVE THE CREDIT. Enter the portion of your overpayment you wish to have credited to next year's estimated tax liability.

LINE 23: REFUND. Subtract line 22 from line 21 and enter the result on line

23as the amount of refund you are due. A refund of $2 or less will only be sent if you attach a written request to this return.

PART III. NONRESIDENT &

Nonresidents and

LINE 1: TENTATIVE TAX. Compute the tax shown on the income on line 6 of Form

use Schedule T; otherwise, apply the appropriate rate schedule to your taxable income and enter the result on line 1 as your tentative tax.

LINE 2: WEST VIRGINIA INCOME. A

Virginia tax on the following: taxable income received from ALL sources while a West Virginia resident; West Virginia source income earned during the period of nonresidence; and applicable special accruals. A nonresident is subject to West Virginia tax on any West Virginia source income earned during the year.

West Virginia source income of a nonresident includes any gain, loss, or deduction from: real or tangible personal property located in West Virginia; employee services performed in West Virginia; a business, trade, professsion, or occupation carried on in West Virginia; a corporation in which you are a shareholder which elects under federal law to be taxed as an

LINE 3: FEDERAL ADJUSTED GROSS INCOME. Enter the amount shown on line 1, column C of Form

LINE 4: TAX. Divide line 2 by line 3, and round the result to a

PART IV. NONRESIDENT &

Nonresidents and

Please note: Your West Virginia source income does not change due to a net operating loss carry back. A net operating loss carry back is a federal allowance and applies to the Federal Adjusted Gross Income, line 1 of the

Line 5: OTHER INCOME. Subtract line 2 Part III from your original Federal

Adjusted Gross Income (line 1, column A). Note: If you previously amended to correct your original return, use the corrected FAGI.

Line 6: INCOME PERCENTAGE. Divide line 5 by line 3 Part III and round the

result to 4 decimal places. Note: decimal cannot exceed 1.0000.

Line 7: WEST VIRGINIA TAX RATE APPLIED TO OTHER INCOME. Multiply line 1 Part III by the line 6 decimal.

Line 8: TAX CALCULATION. Subtract line 7 from the line 1 Part III.

Line 9: WEST VIRGINIA TAX. Enter the smaller of line 4 Part III or line 8 here and on page 1, line 7, column C and check the box for Part IV.

ATTACH A COPY OF YOUR FEDERAL RETURN INCLUDING

YOUR SCHEDULE

WHEN YOUR RETURN IS COMPLETE

SIGNATURE: SIGN YOUR RETURN! A joint return must be signed by both husband and wife even though only one had income. If you (and your spouse, if a joint return) do NOT sign your return it WILL NOT be processed. If the return is prepared by an authorized agent of the taxpayer, the agent must also sign on the line provided and enter his/her address and phone number below the signature.

Waiver of Confidentiality: If your return was prepared by someone other than yourself, initialing the box(es) will allow the department to contact the preparer regarding any questions that may arise.

Be sure to include any schedules and statements required to be submitted with the return. Mail the completed return to: West Virginia State Tax

Department Revenue Division, P.O. Box 1071, Charleston, West Virginia

Documents used along the form

The West Virginia IT-140X form is an essential document for individuals looking to amend their state income tax returns. When filing this form, several other documents may also be required to ensure a complete and accurate submission. Below is a list of commonly used forms and documents that often accompany the IT-140X, each serving a specific purpose in the amendment process.

- Form IT-140: This is the original West Virginia Personal Income Tax Return. If you are amending your return, you must reference the original form to indicate what changes are being made.

- Form IT-140NR/PY: This form is for nonresidents and part-year residents of West Virginia. It is used to report income earned in the state and is relevant if the taxpayer's residency status has changed since the original filing.

- Form IT-140NRS: This is the West Virginia Nonresident Special Return. It is utilized by nonresidents who have specific types of income from West Virginia sources, such as rental income or business income.

- Schedule M: This schedule is used to report modifications to income. If you are making changes to your federal adjusted gross income, you must attach a corrected Schedule M to explain those adjustments.

- Schedule E: This schedule is for claiming credits for taxes paid to other states. If you are amending your return to include such credits, a corrected Schedule E must be attached along with documentation of the taxes paid.

- Texas Real Estate Purchase Agreement: This is an essential document utilized for property transactions in Texas. For comprehensive information, visit TopTemplates.info.

- Form WV/SCTC-1: This form is used to claim the Senior Citizens Tax Credit for property tax paid. If you are amending your return to include this credit, you will need to attach this form.

Each of these documents plays a crucial role in the amendment process. By ensuring that all necessary forms are included, taxpayers can facilitate a smoother review and processing of their amended returns. Proper documentation helps to clarify changes and supports the accuracy of the filing, ultimately benefiting both the taxpayer and the state tax authority.