Official West Virginia Opt 1 Template in PDF

Key takeaways

Here are some key takeaways about filling out and using the West Virginia Opt 1 form:

- Eligibility: This form is for taxpayers who want to opt out of electronic filing when their tax preparer is required to file electronically.

- Voluntary Choice: By signing the form, you indicate that you have voluntarily chosen not to have your return filed electronically.

- Tax Preparer's Role: The tax preparer must acknowledge that they did not request you to opt out of electronic filing.

- Retention Requirement: Tax preparers must keep this form for three years after the tax year for which it was signed.

- Joint Filers: If you are filing jointly, both you and your spouse must sign the form.

- Primary Information: You need to provide your name, Social Security number, and, if applicable, your spouse's information.

- Indication on Tax Return: The preparer must indicate on your tax return that you opted out of electronic filing.

Additional PDF Templates

Business License Wv - The form includes provisions for providing fax numbers for quicker communication regarding the request.

This form can be accessed and downloaded through resources like TopTemplates.info, which provides templates to simplify the purchase process and ensure all necessary information is accurately captured in the agreement.

West Virginia Cd 3 - The state aims to reach a resolution that benefits both parties involved.

Misconceptions

Here are some common misconceptions about the West Virginia Opt 1 form:

- Only certain taxpayers can use the Opt 1 form. Anyone who is working with a tax preparer required to e-file can opt out, regardless of their income level.

- The form is only for those who do not want to e-file. The Opt 1 form is specifically for taxpayers who wish to formally state their choice to opt out of electronic filing.

- You must have a specific reason to opt out. While you can provide a reason, it is not mandatory. Simply choosing to opt out is sufficient.

- Only tax preparers can fill out the form. Taxpayers can fill out the form themselves, but it must be signed by both the taxpayer and the preparer.

- The Opt 1 form is only for joint filers. Both single and joint filers can use the form. Joint filers just need both signatures.

- Once you opt out, you can never e-file again. Opting out is specific to the current tax return. You can choose to e-file in future years.

- Submitting the form is complicated. The form is straightforward. It requires basic information and signatures.

- The tax preparer must request you to opt out. It is your choice to opt out, and the preparer does not need to suggest it.

- You need to submit the form with your tax return. The form is retained by the tax preparer and does not need to be submitted with your return.

- The Opt 1 form is a new requirement. This form has been in place since January 1, 2011, and is part of the e-filing regulations.

Similar forms

The West Virginia Opt 1 form shares similarities with the IRS Form 8948, which is used to indicate that a taxpayer has opted out of e-filing. Both forms serve the purpose of allowing taxpayers to choose a paper filing option instead of electronic submission. This choice is particularly relevant when taxpayers feel uncomfortable with electronic filing or when their returns do not meet the criteria for e-filing. Just like the Opt 1 form, IRS Form 8948 requires signatures from both the taxpayer and the tax preparer, affirming that the decision to opt out was made voluntarily and without coercion.

Another document that resembles the West Virginia Opt 1 form is the State of California Form 8453, which is used for e-filing purposes. This form allows taxpayers to affirm their choice to file a paper return after e-filing their federal tax return. Similar to the Opt 1 form, it ensures that the taxpayer's decision is documented and signed, providing a clear record for both the taxpayer and the tax preparer. Both forms emphasize the importance of maintaining compliance with state regulations while allowing personal preferences to guide filing methods.

The New York State Form IT-201, which is the resident income tax return, also shares features with the West Virginia Opt 1 form. While IT-201 is primarily for filing purposes, it includes sections where taxpayers can indicate their preferences regarding electronic submission. Both forms require taxpayers to provide personal information and signatures, ensuring that their choices are formally recorded. This commonality highlights the importance of taxpayer autonomy in the filing process across different states.

Similar to the Opt 1 form, the Florida Form DR-501 is used by taxpayers to opt out of electronic filing. This form allows individuals to choose to submit their returns on paper if they prefer not to e-file. Both forms require clear communication of the taxpayer's wishes and the reason for opting out, reinforcing the need for transparency in the filing process. The signatures from both the taxpayer and the preparer serve as a safeguard against misunderstandings regarding filing preferences.

The Illinois Form IL-1040 also has a parallel structure to the West Virginia Opt 1 form. Taxpayers in Illinois can use this form to indicate their preference for paper filing over electronic submission. Like the Opt 1 form, it requires essential taxpayer information and the signatures of both parties involved. This similarity underscores the importance of documenting taxpayer choices in a manner that is compliant with state tax regulations, ensuring that both the taxpayer's rights and the preparer's responsibilities are clearly defined.

When considering the various forms used for tax filings across different states, it's important to note how these documents cater to the preferences of the taxpayer. For instance, the West Virginia Opt 1 form allows individuals to choose paper filing over electronic submission, a sentiment echoed in the New York ATV Bill of Sale form, which provides a reliable method for documenting vehicle transactions. As you explore options for ensuring compliance and maintaining thorough records, resources such as smarttemplates.net can offer valuable templates and guidelines tailored to your needs.

Additionally, the Texas Form 1040-EZ provides a simplified option for taxpayers who wish to file their returns on paper. This form allows taxpayers to indicate their choice not to e-file, similar to the West Virginia Opt 1 form. Both documents require the taxpayer's personal information and signatures to confirm the decision. This shared feature emphasizes the importance of taxpayer agency in choosing how they wish to file their returns, regardless of the state in which they reside.

Finally, the Pennsylvania Form 40 is another document that parallels the West Virginia Opt 1 form. This form allows taxpayers to opt out of electronic filing, providing a paper filing option instead. Both forms require signatures from the taxpayer and the preparer, ensuring that the decision to opt out is clearly communicated and documented. This commonality reflects a broader trend in state tax systems to accommodate taxpayer preferences while maintaining compliance with filing requirements.

Key Facts about West Virginia Opt 1

What is the purpose of the West Virginia Opt 1 form?

The West Virginia Opt 1 form is used by taxpayers who wish to opt out of having their personal income tax returns electronically filed by their tax preparer. This option is available to individuals whose tax preparers are required to file electronically due to the number of returns they handle. By completing this form, taxpayers indicate their preference for paper filing instead of electronic submission.

Who needs to complete the Opt 1 form?

Taxpayers who receive services from a tax preparer that files more than 25 tax returns using tax preparation software must complete the Opt 1 form if they choose not to have their return filed electronically. Both the taxpayer and their spouse, if filing jointly, must sign the form to confirm their decision.

How long does a tax preparer need to keep the Opt 1 form?

The tax preparer is required to retain the Opt 1 form for three tax years following the year for which it was signed. This retention is important for compliance and record-keeping purposes. The tax preparer must also indicate on the taxpayer's return that the taxpayer has opted out of electronic filing.

What should I do if I want to opt out?

If you decide to opt out of electronic filing, you need to complete the Opt 1 form with your personal information, including your Social Security number. You must also provide a reason for opting out. After signing the form, give it to your tax preparer, who will keep it on file for the required period.

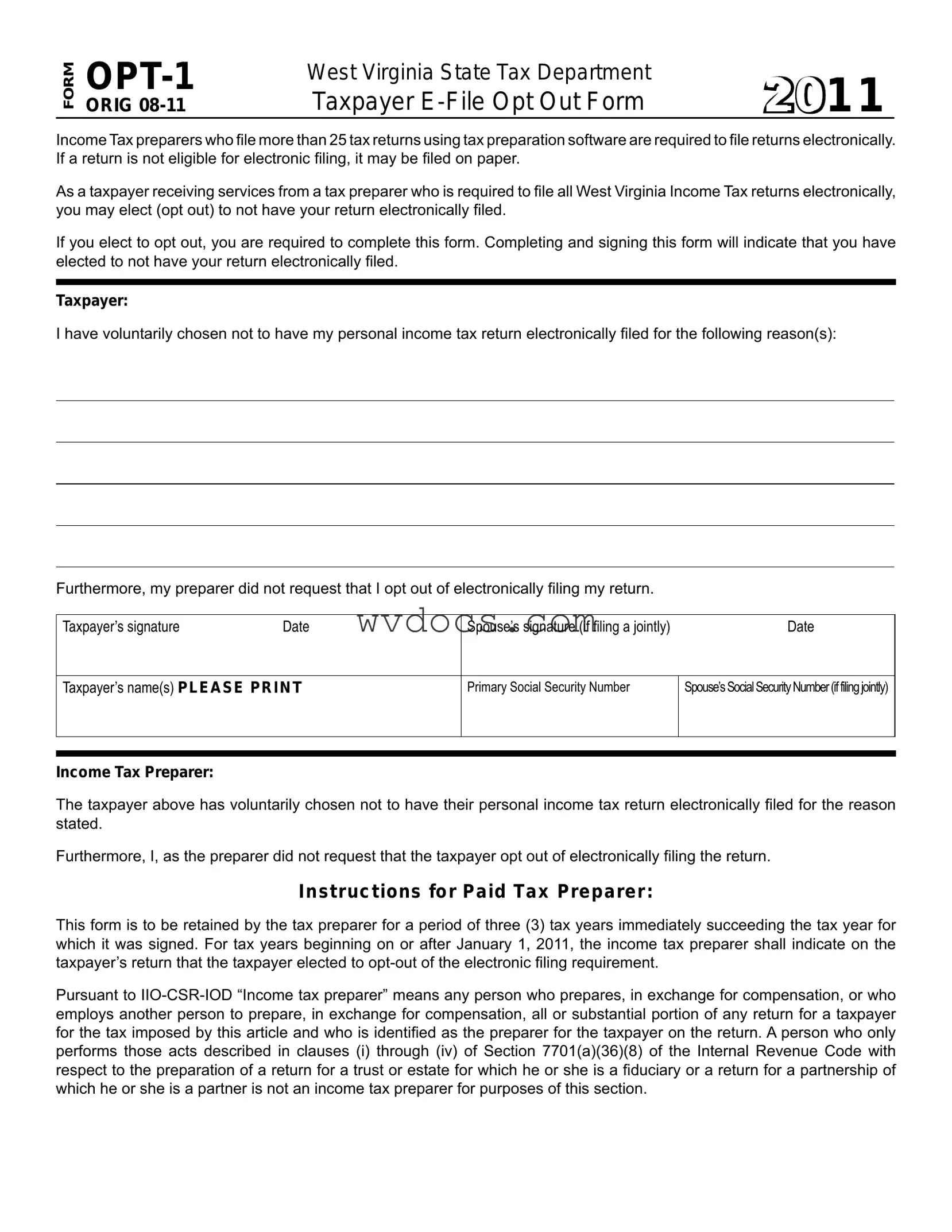

Preview - West Virginia Opt 1 Form

FORM

ORIG

West Virginia State Tax Department |

2 0 1 1 |

Taxpayer |

Income Tax preparers who ile more than 25 tax returns using tax preparation software are required to ile returns electronically. If a return is not eligible for electronic iling, it may be iled on paper.

As a taxpayer receiving services from a tax preparer who is required to ile all West Virginia Income Tax returns electronically, you may elect (opt out) to not have your return electronically iled.

If you elect to opt out, you are required to complete this form. Completing and signing this form will indicate that you have elected to not have your return electronically iled.

Taxpayer:

I have voluntarily chosen not to have my personal income tax return electronically iled for the following reason(s):

Furthermore, my preparer did not request that I opt out of electronically iling my return.

Taxpayer’s signature |

Date |

Spouse’s signature (if iling a jointly) |

Date |

Taxpayer’s name(s) PLEASE PRI N T

Primary Social Security Number

Spouse’s Social Security Number (if filing jointly)

Income Tax Preparer:

The taxpayer above has voluntarily chosen not to have their personal income tax return electronically iled for the reason stated.

Furthermore, I, as the preparer did not request that the taxpayer opt out of electronically iling the return.

I nst ruc t ions for Pa id Ta x Pre pa re r:

This form is to be retained by the tax preparer for a period of three (3) tax years immediately succeeding the tax year for which it was signed. For tax years beginning on or after January 1, 2011, the income tax preparer shall indicate on the taxpayer’s return that the taxpayer elected to

Pursuant to

Documents used along the form

The West Virginia Opt 1 form is essential for taxpayers who wish to opt out of electronic filing of their income tax returns. However, several other documents may accompany this form to ensure compliance with state tax regulations. Below is a list of relevant forms and documents that are commonly used alongside the West Virginia Opt 1 form.

- West Virginia Personal Income Tax Return (Form IT-140): This is the standard form used by residents to file their personal income tax. It details income, deductions, and credits, and must be completed accurately to ensure proper tax assessment.

- Tax Preparer Authorization Form (Form 2848): This document allows taxpayers to authorize a specific individual or firm to represent them before the West Virginia State Tax Department. It is important for communication and for resolving any tax issues.

- California ATV Bill of Sale Form: This document is essential for recording the sale and transfer of ownership of an all-terrain vehicle (ATV) in California, ensuring compliance with state regulations. For more information, visit https://onlinelawdocs.com/california-atv-bill-of-sale.

- Income Tax Extension Request (Form IT-EXT): Taxpayers may use this form to request an extension for filing their income tax return. It grants additional time to submit the return but does not extend the time to pay any taxes owed.

- West Virginia Schedule A (Form IT-140S): This form is used to itemize deductions for taxpayers who choose not to take the standard deduction. It is essential for maximizing potential tax savings based on individual circumstances.

- West Virginia Taxpayer Information Update Form: This form is used to update any changes to taxpayer information, such as address or filing status. Keeping this information current is crucial for accurate tax processing and communication.

Understanding these documents can help ensure a smoother filing process and compliance with state tax laws. Taxpayers should consider consulting with a tax professional if they have questions about any of these forms or their specific tax situation.